A step-by-step guide in to completing your Transfer Balance Account Reporting (TBAR) to the Australian Taxation Office (ATO)

SMSF trustees can lodge a Transfer Balance Account Report (TBAR) to report information to the ATO by completing the online form or mailing a paper report.

Alternatively, you can seek assistance from a Specialist SMSF Advisor, find one via our ‘Find a Specialist’ function here.

A separate TBAR must be lodged for events impacting each member of a fund. A maximum of four events can be reported for a member. Multiple TBARs will need to be lodged if there are more than four events to report.

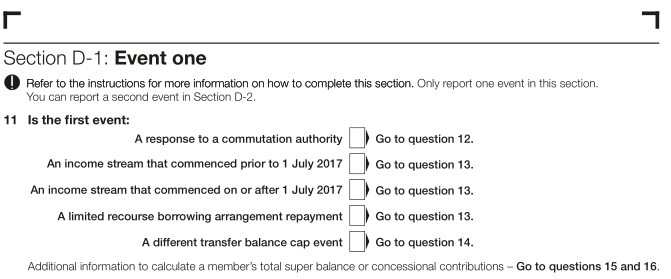

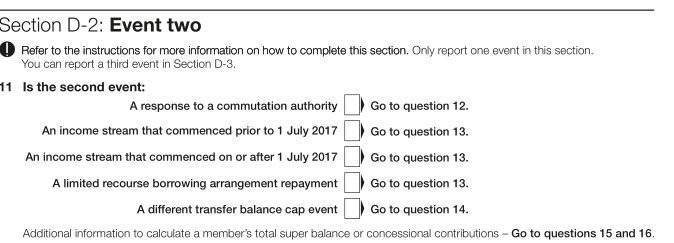

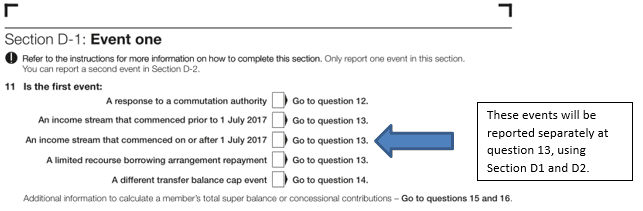

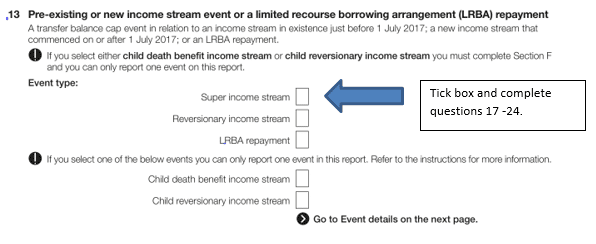

Section D of the report outlines how to complete the form and which question needs to be answered.

Do not report more than one event in Section D1. For example, if you need to report two events for a member you will need to fill out sections D1 and D2.

Example 1 – pre-existing income stream

This example is for members with income streams that were being received on 30 June 2017.

If an SMSF member has a pre-existing income stream on 30 June 2017 it must be reported on the TBAR on or before 1 July 2018. A pre-existing income stream is an income stream the member was receiving on 30 June 2017 that:

- Continued to be paid to them on or after 1 July 2017, and

- Is in retirement phase.

For example:

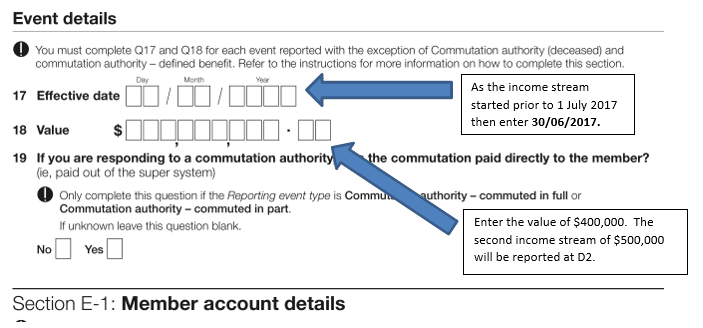

Ruth is the sole member and trustee of her SMSF, Diamond Sparkle Super Fund. Ruth is receiving two retirement phase superannuation income streams, which commenced prior to 1 July 2017. The value of the income streams is $400,000 and $500,000 respectively.

The Diamond Sparkle Super Fund waits until after its financial accounts have been completed before separately reporting 30 June 2017 (to show each income stream was a pre-existing income stream) and value at just before 1 July 2017 of each income stream on or before 1 July 2018.

Example 2 – New income stream and member commutation

This example is for members that have a new income stream.

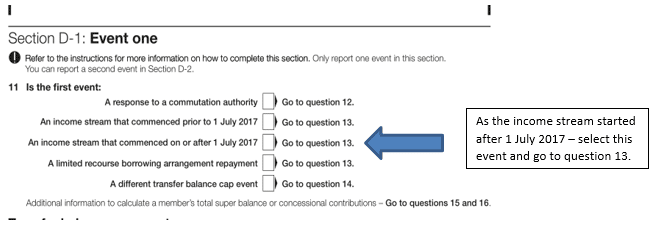

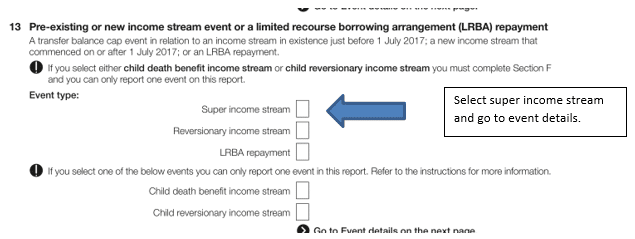

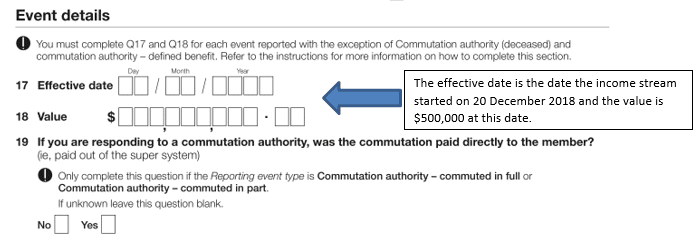

Brenton commences a retirement income stream on 20 December 2018 valued at $500,000 and commutes $100,000 back to accumulation account on 20 February 2019.

The income stream is an account based pension.

The commutation can be reported on the same report, as the event is that of the same member. The details of the event will be completed in section D2.

Disclaimer: The information contained in this document is provided for educational purposes only, is general in nature and is prepared without taking into account particular objective, financial circumstances, legal and tax issues and needs. The information provided in this article is not a substitute for legal, tax and financial product advice. Before making any decision based on this information, you should assess its relevance to your individual circumstances. While SMSF Association believes that the information provided in this article is accurate, no warranty is given as to its accuracy and persons who rely on this information do so at their own risk. The information provided in this bulletin is not considered financial product advice for the purposes of the Corporations Act 2001.