Content provided by Income Asset Management

In his latest feature for Income Asset Management, bond market expert Matthew Macreadie – Director of Credit Strategy at IAM – highlights the risks for investors to be aware of with Hybrid investment instruments.

In today’s low interest rate environment where term deposit rates have remained stuck near zero, hybrid investment options have become more popular.

So-named because they typically include characteristics of both debt and equity investments, investors have been attracted to the regular distribution payments, along with the higher-return profile of hybrids compared to bonds.

However, despite their many positive features, hybrids do carry higher risks compared to Australian corporate bonds – which many investors don’t realise.

While allocating a small portion to hybrids can be effective, an approach highly focused on this asset class could pose problems. Here’s a few points to note, for starters:

- Hybrids historically have had a higher correlation to equity markets

- Hybrid debt issues are less frequent than Australian corporate bond issues

- Hybrids have significant call-risk relative to Australian corporate bonds.

That last point, call risk, is the risk that a hybrid issuer may forcibly redeem the hybrid instrument prior to maturity – which may not suit the time frame of the investor who acquired it.

IAM’s suggested approach would be to adopt a diversified portfolio, with adequate exposure to Australian corporate bonds alongside hybrids.

Particularly in today’s environment, IAM place an emphasis on downside protection during market turbulence – like we have seen in the past few months.

There’s no doubt hybrids have a place, though the current returns from hybrids (especially financial hybrids) do look on the expensive side on a risk-reward basis.

For example, the investment yield to expected maturity/first call on Australian bank hybrids are currently trading at around 3-4% (unfranked).

IAM believes five-year bank hybrids offer better value at around the 5-6% mark (unfranked). Here are three reasons why:

1. Hybrids historically have had a higher correlation to equity markets

Over the GFC period, bank hybrids experienced close to a 20% drawdown (or price decline).

That fall was primarily attributable to capital losses from the discount margins on these securities, which increased from around 1% pre-GFC to around 5.5% post-GFC.

Using this as a proxy for the current environment, if discount margins were to increase from the current 2.75% to around 5% over the next year, the capital loss would be ~6.5% offset by 2.75% income – thus, a drawdown of ~3.75%.

The recent experience for bank hybrids has been more muted. Bank hybrids are down by around 2-3% (in price terms) over calendar 2022 YTD compared to the ASX200, which has seen more volatility.

The GFC period was highlighted by:

A fear of economic slowdown/banking crisis;

Protected equity market weakness; and

- Large drawdowns (bank share prices falling by 20% plus).

The chart below gives a longer-term perspective of credit (or discount margins) for four types of credit investments: BBB rated bonds, US High Yield, CoCo (non-AUD, AT1/Hybrids), and Australian AT1/Hybrids). The last data point is 26 January 2022.

While BBB rated bonds do have some spread volatility (albeit, less so than AT1/hybrids), the bulk of the Australian corporate bond market sits in the A rating and above.

A-rated bonds have historically had very low spread volatility, and their risk-reward characteristics are better given the potential drawdown risks that currently exist in the market.

2. Hybrid debt issues are less frequent than Australian corporate bond issues

The Australian corporate bond market has grown by more than 40% since 2010.

Currently, there are over $1 trillion of Australian corporate bonds outstanding across governments (state and federal), asset-backed securities, financial and non-financial corporates, inflation issuers, and hybrids.

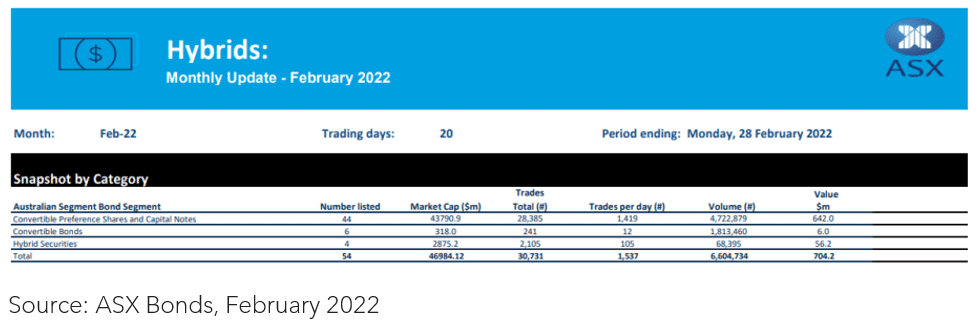

However, the hybrid market is only a tiny segment of the Australian corporate bond market at ~$47 billion, or 5% of Australian corporate bonds outstanding.

Most of the debt issues are classified as ‘convertible preference shares and capital notes’, and are issued from several financial institutions (mostly the major banks and Macquarie).

This also creates significant concentration issues with the Australian banking sector.

In years past, hybrids were also used by large corporates (for example, Crown, Nufarm, and Qube) to obtain a level of equity credit in order to improve their credit metrics.

Rating agencies have since made this process more onerous on issuers, which, alongside the improved liquidity for cheap funding from the corporate bond market, has seen a tailing off in corporate hybrid supply.

The issue hence becomes one in which investors can only get exposure to hybrids via the banks.

As debt issues are less frequent in nature, replacement of capital then becomes very difficult, which poses reinvestment risk.

Generally, the hybrid market is also not a heavily secondary traded market. On average, the number of trades per day is around 1,500, with a value of ~$700m.

As an example of how that higher risk plays out in the market, the bid-offer spreads (i.e., the difference between the market price at which the hybrids can be bought and sold) for CBA hybrid securities can be larger than the spread on its actual shares.

3. Hybrids have significant call risk relative to Australian corporate bonds

The perpetual nature of many hybrids (especially the financial hybrids) means there is essentially no guarantee of getting your money back, and thus no reliable yield to maturity (%).

There are ‘reset periods’ with ‘reset margins’ but there is no end date for getting paid back.

For this reason, investors are generally better placed to assess the running yield (%) for that period, and then make a judgement as to whether they are comfortable or not.

Call risk also tends to rise in a higher interest rate environment, as the issuer can hold onto old, low-rate hybrids rather than issuing new hybrids which have a higher rate of interest.

Generally, corporate bonds have a hard bullet maturity. All-else-equal, investors can be comfortable with the yield to maturity (%) on offer.

The other issue is that if a hybrid isn’t redeemed, it’s probably going to be a result of wider market turbulence.

So, if an investor wanted to exit, they’d be selling into the eye of the storm and potentially running into liquidity issues and realising a sizeable capital loss to do so.

To find out more information on Corporate Bonds, please call 1300 784 132 or visit incomeam.com.

Content provided by:

Disclaimer

Sample portfolio disclosure

Pricing as at 14 February 2022.

IAM Capital Markets Limited (AFSL 283119) (‘IAM Capital Markets’) financial service business and provides general financial product advice only. As a result, this document, the Content and the Reports are not intended to provide financial product advice and must not be relied upon or construed as such. IAM Capital Markets does not express any opinion on the future or expected value of any financial product and does not explicitly or implicitly recommend or suggest an investment strategy of any kind. The Content and the Reports provided in this document have been prepared based on available data to which IAM Capital Markets have access. Neither the accuracy of that data nor the research methodology used to produce the Content and Reports can be or is guaranteed or warranted. Some of the research used to create the Content and the Reports is based on past performance. Past performance is not an indicator of future performance. The data generated by the research in the Content or the Reports is based on research methodology that has limitations; and some of the information in the Content or the Reports is based on information from third parties. IAM Capital Markets does not guarantee the currency of the Content or the Reports. If you would like to assess the currency, you should compare the Content or the Reports with more recent characteristics and performance of the assets mentioned within it.

You acknowledge that investment can give rise to substantial risk and a product mentioned in the Content or the Reports may not be suitable to you. The Content and Reports have been provided or made available by IAM Capital Markets without taking account of your objectives, financial situation, and needs. IAM Capital Markets strongly recommends that you seek independent accounting, financial, taxation, and legal advice, tailored to your specific objectives, financial situation or needs, prior to making any investment decision. Neither IAM Capital Markets, nor any of its directors, authorised representatives, employees, or agents, makes any representation or warranty as to the reliability, accuracy, or completeness, of the Content and Reports. Nor does IAM Capital Markets accept any liability or responsibility arising in any way (including negligence) for errors in, or omissions from the Content and Reports. IAM Capital Markets, its staff and related parties earn fees and revenue from dealing in the securities as principal or otherwise and may have an interest in any securities mentioned in this document.

Any reference to credit ratings of companies, entities or financial products must only be relied upon by a ‘wholesale client’ as that term is defined in section 761G of the Corporations Act 2001 (Cth). IAM Capital Markets does not provide tax advice and is not a registered tax agent or tax (financial) advisor, nor are any of IAM Capital Markets’ staff or authorised representatives. IAM Capital Markets does not make a market in the securities or products that may be referred to in this document. An investment in notes or corporate bonds should not be compared to a bank deposit. Notes and corporate bonds have a greater risk of loss of some or all an investor’s capital when compared to bank deposits. IAM Capital Markets is not licensed to provide foreign exchange hedging or deal in foreign exchange contracts services. IAM Capital Markets may quote to you an estimated yield when you purchase a bond. This yield may be calculated by IAM Capital Markets on either A) a yield to maturity date basis; or B) a yield to early redemption date basis. Some bond issuances include multiple early redemption dates and prices, therefore the realised yield earned by you on the bond may differ from the yield estimated or quoted by IAM Capital Markets at the time of your purchase.

BondAdviser has acted on information provided to it and our research is subject to change based on legal offering documents. This research is for informational purposes only. We note that this security offering is only being made to investors who are not retail clients under the Corporations Act nor located outside Australia This information discusses general market activity, industry or sector trends, or other broad-based economic, market or political conditions and should not be construed as research or investment advice. The content of this report is not intended to provide financial product advice and must not be relied upon as such. The Content and the Reports are not and shall not be construed as financial product advice. The statements and/or recommendations on this web application, the Content and/or the Reports are our opinions only. We do not express any opinion on the future or expected value of any Security and do not explicitly or implicitly recommend or suggest an investment strategy of any kind. The content and reports provided have been prepared based on available data to which we have access. Neither the accuracy of that data nor the methodology used to produce the report can be guaranteed or warranted. Some of the research used to create the content is based on past performance. Past performance is not an indicator of future performance. We have taken all reasonable steps to ensure that any opinion or recommendation is based on reasonable grounds. The data generated by the research is based on methodology that has limitations; and some of the information in the reports is based on information from third parties. We do not guarantee the currency of the report. If you would like to assess the currency, you should compare the reports with more recent characteristics and performance of the assets mentioned within it. You acknowledge that investment can give rise to substantial risk and a product mentioned in the reports may not be suitable to you. You should obtain independent advice specific to your particular circumstances, make your own enquiries and satisfy yourself before you make any investment decisions or use the report for any purpose. This report provides general information only. There has been no regard whatsoever to your own personal or business needs, your individual circumstances, your own financial position or investment objectives in preparing the information. We do not accept responsibility for any loss or damage, however caused (including through negligence), which you may directly or indirectly suffer in connection with your use of this report, nor do we accept any responsibility for any such loss arising out of your use of, or reliance on, information contained on or accessed through this report.