Content provided by OTG Capital

Written by Ray Trevisan, Director, OTG Capital Pty Limited

Cash or shares – Shares or cash

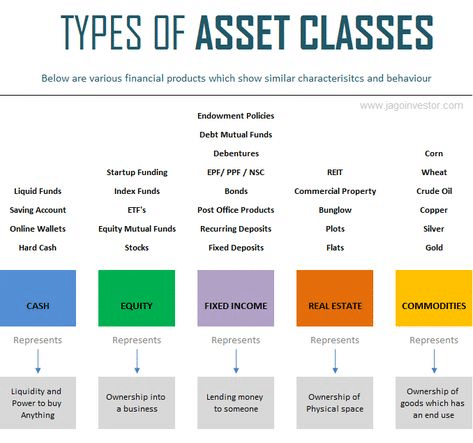

Why are these the only 2 asset classes I seem to hear about in my travels and discussions with investors of all persuasions? There are actually 5 asset classes:

- Cash – liquid and powerful to buy anything immediately.

- Equity – owning part of a business (aka – Shares!)

- Fixed Income – lending money (and getting it back)

- Real Estate – owning a physical space, and

- Commodities – owning something that has an end use.

I understand why commodities are not widely discussed; gold, silver, lithium and the like all have vibrant active markets attached to them. But they are mostly difficult to understand and require expertise well beyond the average consumer.

The uninformed who venture into this space usually get burned. There is many a “war story” attached to speculative purchases of diamonds, precious gems or metals that end in tears.

And while we are a real estate crazed country, transactions are not regular and usually require much larger sums to participate.

Low Interest Rates are Here to Stay

Today, I wish to investigate the world of Bonds. Why? Because the world of low interest rates is now baked into first world economies. The chase for yield is more important than ever as a bevy of investors (many including retirees trying to eke out a living on their cash savings) are wondering where to place their money.

What are Bonds?

Put simply, a bond is a loan.

If you have ever borrowed money from a bank for a home, a car, a small business, that loan is a “bond”. Bonds engender key principles that have been in place ever since money was invented and lenders worked out a way to make a profit by loaning funds.

Terminology

So, let’s talk about terminology, because that’s what makes bonds difficult to understand on the surface. Jargon, industry speak and terms we’re not familiar with is used by the finance game to dress up what is simply – a loan.

Bond = loan = bearer bonds = registered bonds = unregistered bonds = secured bonds = unsecured bonds – debentures

Interest = coupon rate = return = yield = coupon payments = interest terms

Term = maturity date = loan duration

Principle = face amount = loan amount = par value

Security = collateral = asset backing = collateralised debt options = debt to equity swaps = lien = caveat

Contract = indenture = mortgage agreement = bond certificate = terms & conditions = prospectus = information memorandum

Call provisions = early payment terms = borrower default = annulment = convertible notes = tradeable bonds

Understanding the Jargon!

When we borrow money from the bank, we usually understand:

- How much we’re borrowing; (principle)

- How long we’re borrowing for; (term)

- The interest we’re paying; (coupon rate)

- Any security or collateral the loan is set against; (mortgage on a house, lien on a car or unsecured)

- Terms & conditions of the loan; (early payments, what happens if I don’t pay on time or ever?)

Tables are Turned

When investing in bonds, you need to position yourself on the other side of the transaction.

You are now providing your money to someone else like a company, investment trust or similar.

Therefore, what terms and conditions are you happy for someone else to have your cash, and when do you want the cash returned.

Investing in Bonds

I can’t stress this enough – investing in Bonds can be as risky or as safe as you make it. Like any other investment, you need understand what you’re getting into, and if you don’t understand – don’t invest!!

Applying simple principles around how you might loan money to someone in your family for example, ask yourself these “Six Key Factors of Bonds”:

- Is the country or company a good corporate citizen, do they pay their debts? Do they have a solid track record?

- Maturity. Does the loan suit your liquidity needs (aka when do you need your money back!)

- Return v Risk. Is the return for risk realistic? Does the coupon rate / interest paid match the type of investment or use of the capital? Always remember the higher the yield, usually the higher the risk

- Is the security asset/collateral real? Can it be turned back into cash quickly if needed?

- Plan B. Are you comfortable with the terms if the money comes back in a different form – like equity in the company or convertible notes in the future?

- Are the bonds tradeable in an open marketplace? Can I turn the bond back into cash before its maturity date?

Types of Bonds

Government / Treasury – as the name implies, they are issued by countries in their fiat currency or major currencies like USD, Swiss Francs, Euro, Yen etc.

Municipal / Corporate – issued by companies or lower government agencies looking for funds outside of their usual equity raising to fund expansions, stockholder buy outs or any other use.

Investment Grade – issued by investment vehicles like trusts, funds, broking houses that have been rated by reputable agencies like Moodys or Standard & Poor. Because they are rated doesn’t necessarily make them less risky, they simply have been reviewed by a “third party” agency.

Mortgage backed – issued by investment trusts and funds that use real estate assets (usually) to secure loans in case of default by the borrowers.

Others – any kind of loan that fits the criteria of providing credit, but without any regulation, government rules or protection and might include schemes to fund projects that don’t necessarily meet usual “standard” terms and conditions – aka “the Wild West”, eg- Bitcoin investing.

How Do I Invest in Bonds?

Quite easily I’d suggest. Bonds are available from specialist broking companies that sell a range of bonds, directly with the Bond issuer themselves which include Investment Trusts, companies issuing corporate bonds, mercantile boards of trade and stock exchanges. If you wish to have a wider coverage of bonds, Exchange Traded Funds can assist too, as bond-based ETFs are usually tradeable on stock exchanges around the world.

Conclusion

Bonds can be as safe or as dangerous as you make them.

When you are able to break down the jargon and terminology into simplistic terms that relate to an everyday loan that you have been used to, then investing in bonds – that is – being the provider of the borrowed funds should hopefully be a safer ride than most think.

The golden rules in investing still apply to Bonds including;

- Check against the “Six Key Factors of Bonds”

- If it seems too good to be true, it probably is;

- If you don’t understand what you’re investing, don’t invest; and

- If it doesn’t make sense – DON’T.

About the Author

Ray Trevisan is an Authorised Representative (AR:001250963) of Lifestyle Asset Management, who is the holder of an Australian Financial Services License (AFSL:288421). Ray holds a Master of Management from the University of Technology (Sydney), is a Graduate of the Australian Institute of Company Directors (AICD), NSW Justice of the Peace (JP), an accredited Financial Planner (Dip FinPlng) and member of the Financial Planning Association of Australia (FPA).

Ray has a regular radio show & podcast, Dollar$ and Making $ense. He also has over 40 years of business and investing experience and operates the northern beaches office of OTG Capital in Newport Beach, NSW.