Written by Paul Miron, Managing Director, Msquared Capital

As the dust settles from our post-Australia Day celebrations, we ease into the New Year refreshed and invigorated with our resolutions and plans in motion. We begin to reflect on and update our personal and financial goals for the year and ponder the new year challenges for all of us.

The New Year brings a significant concern for businesses, mortgage holders and consumers. It brings much speculation and uncertainty regarding whether further interest increases will work to stabilise inflation or ultimately tip the Australian economy into a recession. Mortgage holders and business owners remain hopeful that the Reserve Bank will take a momentary pause before considering increasing the official interest rates again. We hold our breath and wait for the anticipated confirmation that the most aggressive period of interest rate increases we have seen in Australia are working to tame inflation.

Below is a summary of the main economic updates over the past three months and an analysis on how this may shape the 2023 economic environment.

Inflation

The single most significant economic metric monitored at the moment is the rapid rise of inflation. Inflation will determine interest rates which in turn will influence asset prices, employment, as well as economic and social stability.

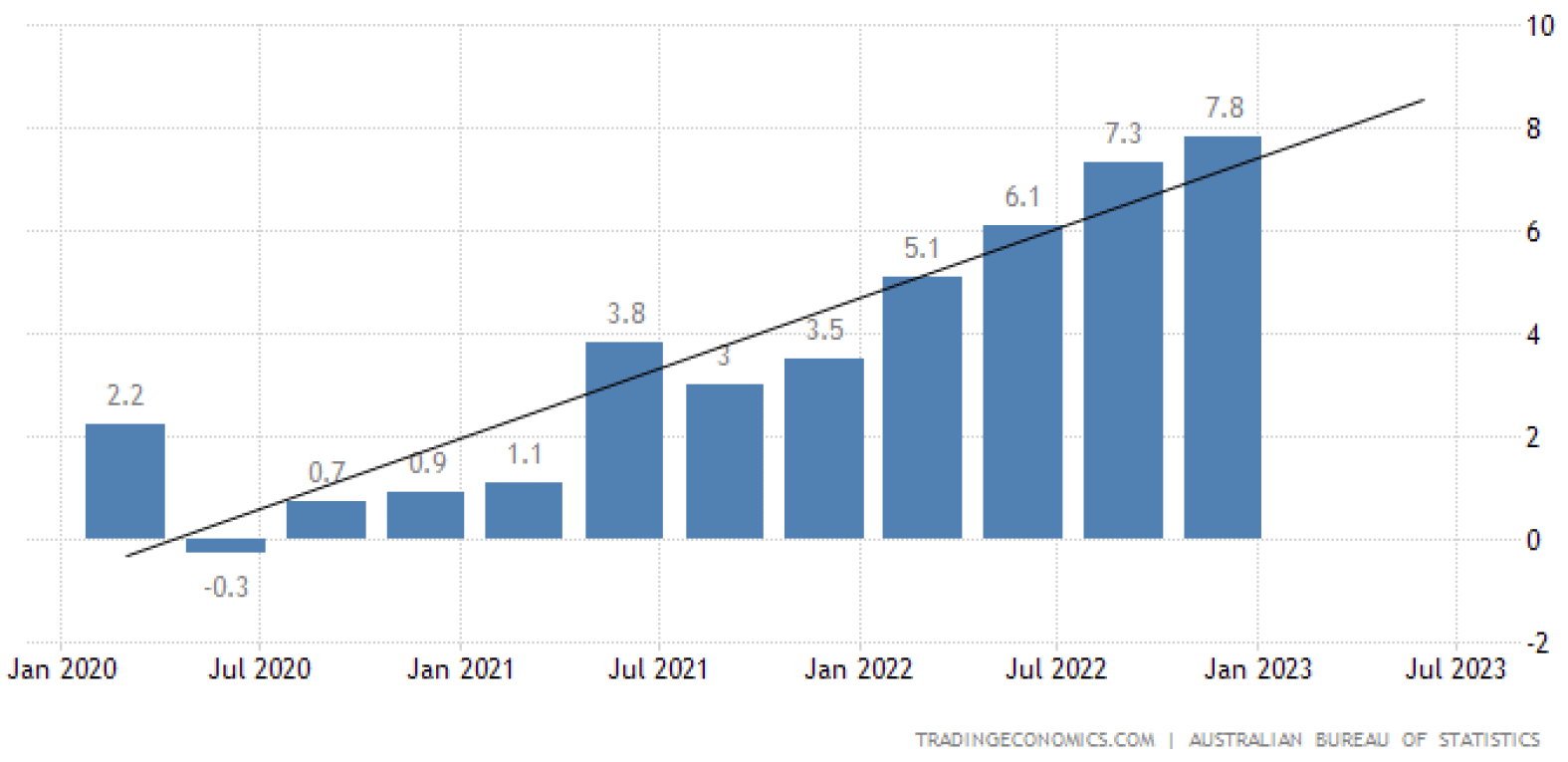

On January 25th, the annual inflation rate for Q4 2022 reached 7.8%, the highest since the early 1990s.

The above graph shows quarterly headline inflation figures from January 2020. This graph can be quite distressing to readers as it demonstrates that inflation figures have accelerated over the last year…without any signs of abating. Even economists are unsure how many more interest rate increases may be required. The predominant view is for further increases of between 0.25% to 1.00% over 2023. Indeed, Phil O’Donaghoe from Deutsche Bank predicts the official cash rate to increase to 4.10% during 2023.

However, what is most concerning is the uniqueness of our current economic environment. Due to the extreme volatility of energy and food prices, COVID-19 lockdowns and supply chain problems, we believe excess money supply is behind the current inflation story. As a result, central banks and economists alike cannot rely upon inflation trajectory data confidently and need to move beyond the headline inflation rate. Consequently, they are more likely to be hawkish and to overshoot the official cash rate in the short term.

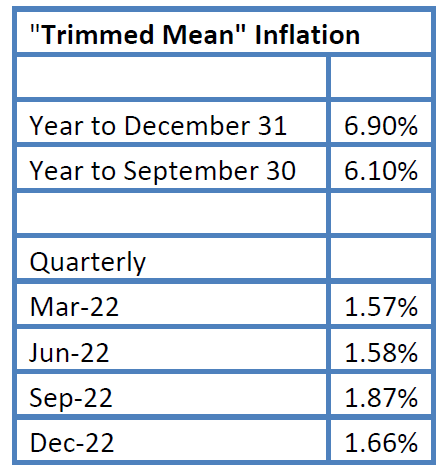

This brings us to a specific measure of inflation that the RBA and other economists are observing today – trimmed inflation. Trimmed inflation is a statistical method used to measure inflation by excluding the highest and lowest values in a data set. This approach is used to remove extreme outliers (or ‘anomalies’) in the data set that could significantly impact the overall calculation of inflation. This method is considered to provide a more robust and accurate measure of inflation compared to the traditional method of calculating the average of all the data points.

One may indeed look at the latest headline inflation figure of 7.8%, which has maintained an upward trend during the last quarter. However, core inflation is actually in decline. This is because core inflation is a measure of inflation that observes the change in the prices of goods and services with the exclusion of volatile industries, such as food and energy. With this bit of information, can we slowly breathe a sigh of relief…or are there further problems associated with an inflation decline as well?

Now, what about the rest of the world? 25 of the 38 OECD countries recorded global inflation declines between the months of October and November 2022. We are likely to follow the international trend, giving confidence to politicians and economists that the worst is truly behind us.

Retail Spending

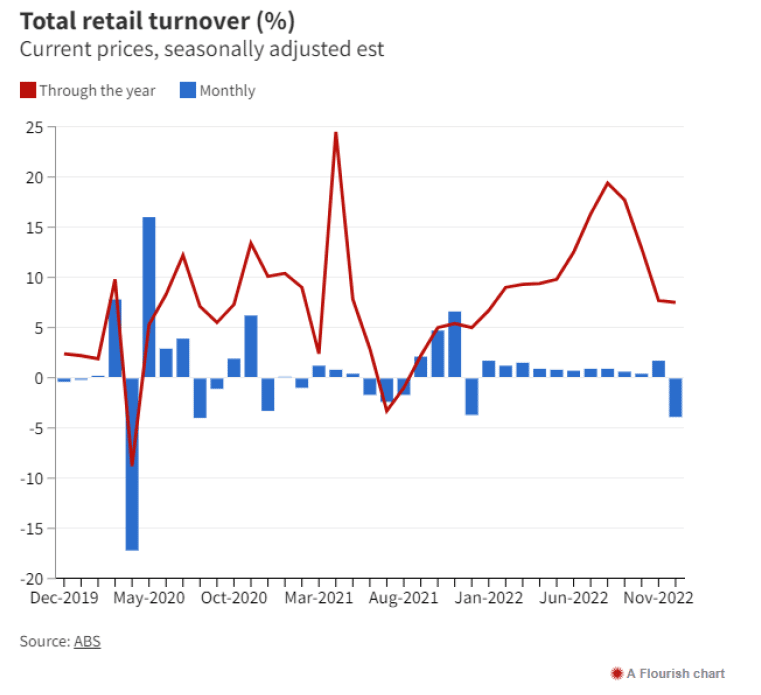

With the average mortgage repayment increasing by 35% over the 2022 calendar year, it has certainly been a surprise that retail spending in November has increased by 1.4% from the previous month. This indicates that the interest rate increases’ full impact has not filtered into everyday spending habits in November.

Indeed just this week, the latest retail figures for December plunged 3.9%. As alarming as this figure is, it is important to keep in mind that this is off a strong base and that current spending is on aggregate higher than pre-pandemic levels, as shown in the graph below.

To read Msquared Capital’s full article on Inflation, Interest Rates, Growth and Property, please click below to download the report.

Content provided by:

Disclaimer:

Msquared Capital Pty Ltd ACN 622 507 297, AFSL No. 520293 (Msquared) is the Trustee of Msquared Contributory Mortgage Income Fund.

The information contained on this website should be used as general information only. It does not take into account the particular circumstances, investment objectives and needs for investment of any investor, or purport to be comprehensive or constitute investment advice and should not be relied upon as such. You should consult a financial adviser to help you form your own opinion of the information, and on whether the information is suitable for your individual needs and aims as an investor. You should consult appropriate professional advisers on any legal, stamp duty, taxation and accounting implications of making an investment.

The information is believed to be accurate at the time of compilation and is provided by Msquared in good faith. Neither Msquared nor any other company in the Msquared Group, nor the directors and officers of Msquared make any representation or warranty as to the quality, accuracy, reliability, timeliness or completeness of material on this website. Except in so far as liability under any statute cannot be excluded, Msquared, its directors, employees and consultants do not accept any liability (whether arising in contract, tort, negligence or otherwise) for any error or omission in the material or for any loss or damage (whether direct, indirect, consequential or otherwise) suffered by the recipient of the information or any other person. The information on this website is subject to change, and the issuer is not responsible for providing updated information to any person. The information on this website is not intended to be and does not constitute a disclosure document as those terms are defined in the Corporations Act 2001 (Cth). It does not constitute an offer for the issue sale or purchase of any securities or any recommendation in relation to investing in any asset.

Investors should consider the Fund’s Constitution, Information Memorandum (IM) and relevant Loan Memorandum (disclosure documents) containing details of investment opportunities before making any decision to acquire, continue to hold or dispose of units in the Fund. You should particularly consider the Risks section of the Information Memorandum and relevant Loan Memorandum. Anyone wishing to invest in a Msquared Contributory Mortgage Income Fund will need to complete an Application Form. A copy of the IM and related Application Form may be obtained from our office via email request from [email protected].

Past performance is not indicative of future performance. No company in the Msquared Group guarantees the performance of any Msquared fund or the return of an investor’s capital or any specific rate of return. Investments in the Fund’s products are not bank deposits and are not government guaranteed. Total returns shown for Msquared Contributory Mortgage Income Fund have been calculated net of fees and any distribution forecasts are subject to risks outlined in the disclosure documents and distributions may vary in the future. All figures and amounts displayed in this email are in Australian dollars. All asset values are historical figures based on our most recent valuations.

The information found on this website may not be copied, reproduced, distributed or disseminated to any other person without the express prior approval of Msquared.