Content provided by The Perth Mint

Written by Jordan Eliseo, Senior Investment Manager, The Perth Mint

Gold has begun 2020 in a strong position, with the yellow metal topping AUD 2,300 per troy ounce in January, an increase of almost 10% for the month.

Driven by geopolitical tensions in the Middle East and fears over the potential spread of coronavirus from China, the increase continues a very strong period of price performance for precious metals, with the gold price up almost 20% in 2019.

Whilst gold is well known as a safe haven asset, there are other positive attributes that it possesses as an investment that are also helping drive demand today.

These attributes include the fact that gold is:

- Easy to invest in

- Highly liquid

- Low cost

Each of these features, and why they are virtues from an investment perspective, are explored in more detail below.

1. Gold is easy to invest in

Gold is incredibly easy to purchase, store and sell.

One of the most popular ways to access gold today is via listed products traded on the ASX, including Perth Mint Gold (ASX ticker code PMGOLD). The product trades like a regular share and is designed to track the performance of gold priced in Australian dollars, with each unit representing 1/100th of a troy ounce of gold.

As such, if gold was trading at AUD 2,300 per ounce, you’d expect to be able to buy and sell PMGOLD via your stockbroker for close to AUD 23 per unit.

Gold can also be bought and stored directly through The Perth Mint via our depository accounts (which allow for trading online, over the phone or via email). Valuations are provided to facilitate the reporting requirements of SMSF trustees.

All client investments stored in The Perth Mint depository are backed by physical gold, the safekeeping of which is guaranteed by the Government of Western Australia.

2. Gold is highly liquid

Liquidity is an important factor for investors to consider, as it impacts how easily one can buy and sell an asset, and what kind of impact their decision to buy or sell will have on the price of the asset.

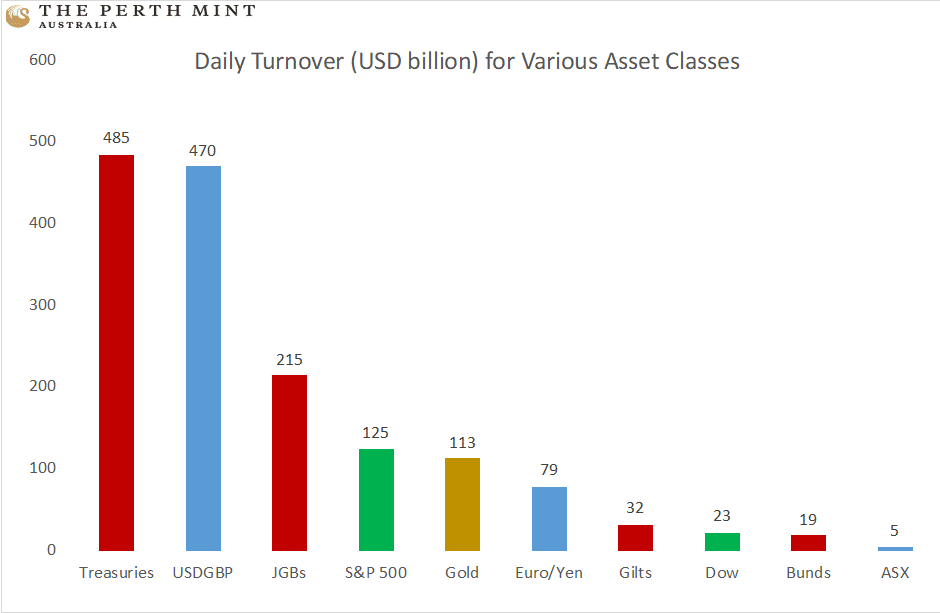

Gold is a highly liquid asset, with daily turnover in the global gold market typically averaging in excess of USD 100 billion. This makes gold one of the most liquid asset classes on the planet. The chart below highlights this, showing the average daily liquidity of gold as well as a variety of major fixed income, equity and currency markets.

As you can see, daily turnover in the gold market is substantially higher than the turnover on the ASX, as well as the turnover seen in many European government bond markets.

Given this liquidity data, SMSF trustees can be very confident that they can trade gold easily, buying into the market, and just as importantly, liquidating their investment, whenever they like.

3. Low Cost

The liquidity and the size of the gold market help make it a very cost-effective asset class for investors to include in their portfolios.

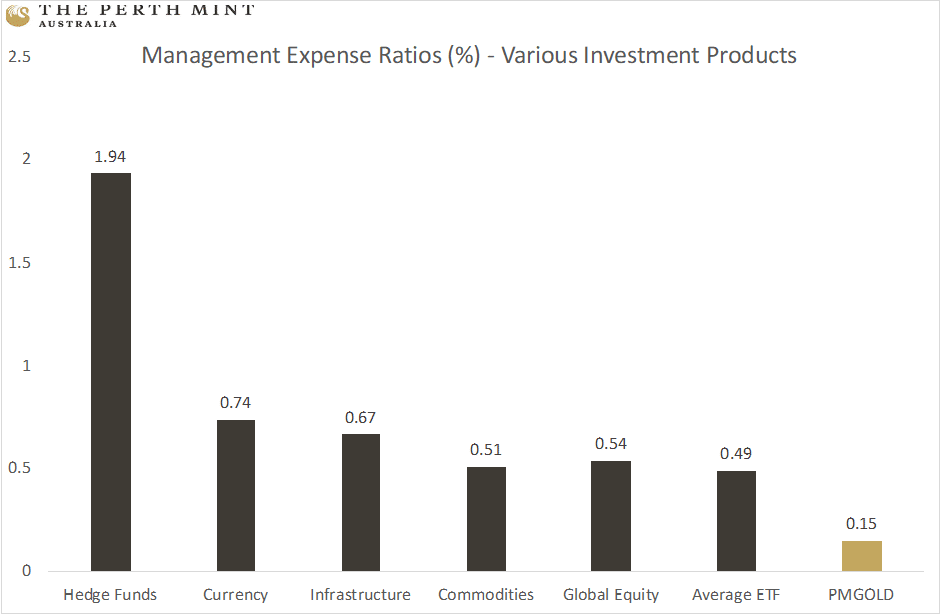

The following chart illustrates this, highlighting the average management expense ratios (MER) for a range of alternative assets, from hedge funds, which are popular with institutional investors, through to currency, infrastructure, commodity and global equity ETFs. The MER is the fee charged by the product provider, which impacts the return the end investor earns from their investment.

The chart also shows the MER for PMGOLD, The Perth Mint’s ASX listed gold product.

The chart highlights the fact that at 0.15%, the MER of PMGOLD is very low, less than one third of ETFs as a whole, putting gold at the very low end of the spectrum from a cost perspective. This is beneficial to the end investor who will get to keep more of the return generated by gold for themselves, rather than paying it away in product fees.

Gold’s low cost, high liquidity and accessibility will continue to drive demand going forward, especially as market pricing suggests we will remain in a low real interest rate environment, which gold has historically outperformed in, for years to come.

Content provided by:

Disclaimer: Past performance does not guarantee future results. The information in this article and the links provided are for general information only and should not be taken as constituting professional advice from The Perth Mint. The Perth Mint is not a financial adviser. You should consider seeking independent financial advice to check how the information in this article relates to your unique circumstances. All data, including prices, quotes, valuations and statistics included have been obtained from sources The Perth Mint deems to be reliable, but it does not guarantee their accuracy or completeness. The Perth Mint is not liable for any loss caused, whether due to negligence or otherwise, arising from the use of, or reliance on, the information provided directly or indirectly, by use of this article.