Content provided by Income Asset Management

Rising inflation poses a huge challenge for investors and necessitates the need for higher yields to ensure portfolios and investment incomes are not declining.

Building a 6% Bond Portfolio

6%pa yield — that’s the magic number many investors said they need to achieve their desired lifestyle. What stood out to us was that many investors were heavily reliant on equities to do that heavy lifting. However, fixed income’s modest risk profile allows for an efficient return per unit of risk.

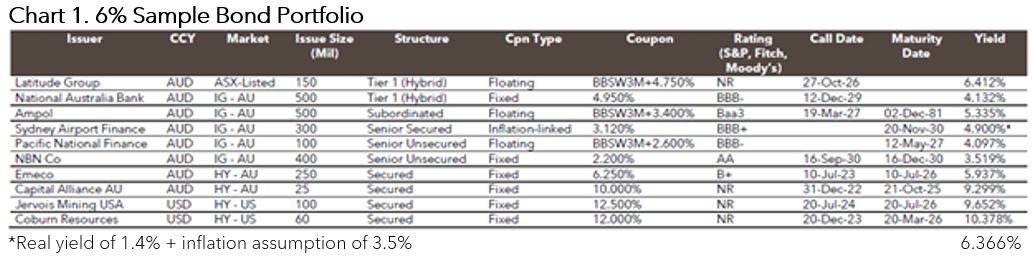

The team at Income Asset Management have taken on the challenge of putting together a hypothetical portfolio of fixed income assets that could deliver on income requirements with a 6%pa yield and offer some diversification.

We’ll explain why diversification is essential to make fixed income work in a portfolio and talk through the ten inclusions in our hypothetical portfolio.

Diversification is the Key

Whether it be in an equity portfolio, property, or fixed income, ensuring risk is spread across a range of individual investments within an asset class helps prevent large negative capital impacts from unforeseen events.

Fixed Income assets, including bonds, inflation-linked bonds, and floating rate notes, allow investors to diversify in four ways:

- Credit or issuer risk: The risk the borrower will default

- Interest rate exposure or duration risk: The term or length of the credit exposure

- Liquidity: How easy is it to get your capital back

- Currency: The currency in which the credit is issued

Fixed income investments also allow investors to manage cashflows (asset/liability match) through interest payments (coupons). Staggering maturity profiles of fixed income investments can help smooth out lumpier capital redemptions. There are few asset classes that can mitigate drawdown risk while providing income/return potential and liquidity.

To achieve a prudent level of diversification, it is important investors have access to a wide range of fixed income securities. Choice, or a diverse view of fixed income markets, is important to assess the value of securities against a broader backdrop of investment opportunities.

IAM Capital Markets are market agnostic. We asses fixed income securities trading in all currencies, through listed exchanges and investment grade and high yield markets globally. This approach ensures investors can adequately assess relative value, diversify portfolios, and access opportunities through different markets.

Drafting a diversified portfolio targeting a ‘high yield’ return of 6% per annum

Let’s get to our high-yield portfolio and run through the different bonds we have selected.

The portfolio includes ten equally-weighted investments spanning ASX-listed, AUD, and USD issues trading in over-the-counter (OTC) markets. The portfolio includes investment grade, sub investment grade, and issues that have not been rated by an agency.

IAM Capital Markets provide internal credit opinions from our Credit Strategy team and independent research reports from our research partner BondAdviser for all issues included in the portfolio.

When putting together the portfolio, these were the steps we followed:

- Range of credit ratings: we chose attackers (lower-rated) and defenders (higher-rated) to ensure that the portfolio can score and defend regularly.

- Range of industries: we chose a midfield that consists of various industries, from airports, banks, mining, telecommunications, and other financial services. Diversification of industries helps to eliminate idiosyncratic risk from a portfolio and lowers a portfolio’s variance. If a midfield is doing their job, the engine room is working.

- Range of maturities: we chose a mixture of short- and long-term bonds. Short-term bonds have less interest rate sensitivity and so act like goalkeepers for capital preservation. Long-term bonds have more interest rate sensitivity, and thus can be more volatile from a capital perspective. We call these the super substitutes!

- Currency: just like having a good manager and coach, you need multiple currencies, including AUD and USD respectively. Both react differently given their volatility relative to the market (or Beta). For instance, the AUD is more sensitive to the terms of trade (TOT) and commodity prices than the USD respectively. However, each currency is just as important to the overall team and desired portfolio outcome.

Latitude Group HLD (Unrated) A solid fintech provider that is better placed than other businesses to deal with implementation of stricter regulation given its long track record. The structure of Latitude notes is very strong. Distributions are deferrable (but cumulative), there is a dividend/buyback stopper, a change of control 5% step-up, and if Latitude notes are not called (at first call), the margin increases to 12.75-13%. Few domestic subordinated financials offer a coupon of BBSW3M+4.75%.

Capital Alliance AU Pty Ltd (Unrated) This is a high-yield senior secured property credit that has three operational hotels and two assets under construction. The covenant package includes a gearing LVR, asset LVR, minimum total tangible asset (TTA) clause, and an interest service reserve account (ISRA). A coupon of 10% for a substantial asset-lend looks appealing versus other high-yield names.

Jervois Mining USA (Unrated) This high-yield credit is uniquely placed in the battery metal thematic (nickel and cobalt). Recent underwritten equity raising has significantly de-risked the credit by raising additional liquidity that can be used over the construction period. First production is due in late 2022. A coupon of 12.5% looks appealing versus the broader USD high-yield universe and other metals and mining names.

Coburn Resources Pty Ltd: 10.735% (Unrated) A high-yield credit uniquely placed to the mineral sands thematic. Mineral sands can be used in a range of everyday household products. All major construction contracts have been awarded and 100% of offtakes have been secured. First production is due in late 2022. A coupon of 12% looks appealing versus the broader USD high-yield universe and other metals and mining names.

Other names in the portfolio which have an external rating (S&P/Fitch/Moody’s) include:

National Australia Bank (BBB-/NA/NA) A solid major bank Tier 1 (Hybrid) security offering a 4.95% coupon.

Sydney Airport Finance (BBB+/NA/Baa1) The number one airport across the country. Protects investors against rising inflation with a coupon of CPI + 3.12%.

Ampol (NA/NA/Baa3) A solid investment-grade credit with a structure which is supportive for investors. The company’s EBITDA looks like turning around quicker than first anticipated − driven by the global energy shortage. If not called in year 5.33, investors can convert to equity, which mitigates any non-call risk. The hybrid security offers a coupon of BBSW3M + 3.40%, which is very attractive compared to the investment-grade space.

Pacific National Finance (BBB-/BBB-/Baa3) A solid haulage company with an increasing revenue base from intermodal (non-coal related activities). This is the best investment-grade bond on a risk-return basis.

NBN Co Ltd (NA/AA/A1) An essential piece of infrastructure for the Australian economy that has strong bipartisan support from both major political parties.

Emeco Pty Ltd (B1/B+/B+) This solid high-yield mining services provider is benefiting from high commodity prices. Potential for upgrade from B+.

To find out more information on the sample portfolio, please call 1300 784 132 or visit Income Asset Management’s webpage here.

Content provided by:

Disclaimer

Sample portfolio disclosure

Pricing as at 14 February 2022.

IAM Capital Markets Limited (AFSL 283119) (‘IAM Capital Markets’) financial service business and provides general financial product advice only. As a result, this document, the Content and the Reports are not intended to provide financial product advice and must not be relied upon or construed as such. IAM Capital Markets does not express any opinion on the future or expected value of any financial product and does not explicitly or implicitly recommend or suggest an investment strategy of any kind. The Content and the Reports provided in this document have been prepared based on available data to which IAM Capital Markets have access. Neither the accuracy of that data nor the research methodology used to produce the Content and Reports can be or is guaranteed or warranted. Some of the research used to create the Content and the Reports is based on past performance. Past performance is not an indicator of future performance. The data generated by the research in the Content or the Reports is based on research methodology that has limitations; and some of the information in the Content or the Reports is based on information from third parties. IAM Capital Markets does not guarantee the currency of the Content or the Reports. If you would like to assess the currency, you should compare the Content or the Reports with more recent characteristics and performance of the assets mentioned within it.

You acknowledge that investment can give rise to substantial risk and a product mentioned in the Content or the Reports may not be suitable to you. The Content and Reports have been provided or made available by IAM Capital Markets without taking account of your objectives, financial situation, and needs. IAM Capital Markets strongly recommends that you seek independent accounting, financial, taxation, and legal advice, tailored to your specific objectives, financial situation or needs, prior to making any investment decision. Neither IAM Capital Markets, nor any of its directors, authorised representatives, employees, or agents, makes any representation or warranty as to the reliability, accuracy, or completeness, of the Content and Reports. Nor does IAM Capital Markets accept any liability or responsibility arising in any way (including negligence) for errors in, or omissions from the Content and Reports. IAM Capital Markets, its staff and related parties earn fees and revenue from dealing in the securities as principal or otherwise and may have an interest in any securities mentioned in this document.

Any reference to credit ratings of companies, entities or financial products must only be relied upon by a ‘wholesale client’ as that term is defined in section 761G of the Corporations Act 2001 (Cth). IAM Capital Markets does not provide tax advice and is not a registered tax agent or tax (financial) advisor, nor are any of IAM Capital Markets’ staff or authorised representatives. IAM Capital Markets does not make a market in the securities or products that may be referred to in this document. An investment in notes or corporate bonds should not be compared to a bank deposit. Notes and corporate bonds have a greater risk of loss of some or all an investor’s capital when compared to bank deposits. IAM Capital Markets is not licensed to provide foreign exchange hedging or deal in foreign exchange contracts services. IAM Capital Markets may quote to you an estimated yield when you purchase a bond. This yield may be calculated by IAM Capital Markets on either A) a yield to maturity date basis; or B) a yield to early redemption date basis. Some bond issuances include multiple early redemption dates and prices, therefore the realised yield earned by you on the bond may differ from the yield estimated or quoted by IAM Capital Markets at the time of your purchase.

BondAdviser has acted on information provided to it and our research is subject to change based on legal offering documents. This research is for informational purposes only. We note that this security offering is only being made to investors who are not retail clients under the Corporations Act nor located outside Australia This information discusses general market activity, industry or sector trends, or other broad-based economic, market or political conditions and should not be construed as research or investment advice. The content of this report is not intended to provide financial product advice and must not be relied upon as such. The Content and the Reports are not and shall not be construed as financial product advice. The statements and/or recommendations on this web application, the Content and/or the Reports are our opinions only. We do not express any opinion on the future or expected value of any Security and do not explicitly or implicitly recommend or suggest an investment strategy of any kind. The content and reports provided have been prepared based on available data to which we have access. Neither the accuracy of that data nor the methodology used to produce the report can be guaranteed or warranted. Some of the research used to create the content is based on past performance. Past performance is not an indicator of future performance. We have taken all reasonable steps to ensure that any opinion or recommendation is based on reasonable grounds. The data generated by the research is based on methodology that has limitations; and some of the information in the reports is based on information from third parties. We do not guarantee the currency of the report. If you would like to assess the currency, you should compare the reports with more recent characteristics and performance of the assets mentioned within it. You acknowledge that investment can give rise to substantial risk and a product mentioned in the reports may not be suitable to you. You should obtain independent advice specific to your particular circumstances, make your own enquiries and satisfy yourself before you make any investment decisions or use the report for any purpose. This report provides general information only. There has been no regard whatsoever to your own personal or business needs, your individual circumstances, your own financial position or investment objectives in preparing the information. We do not accept responsibility for any loss or damage, however caused (including through negligence), which you may directly or indirectly suffer in connection with your use of this report, nor do we accept any responsibility for any such loss arising out of your use of, or reliance on, information contained on or accessed through this report