Content provided by VGI Partners

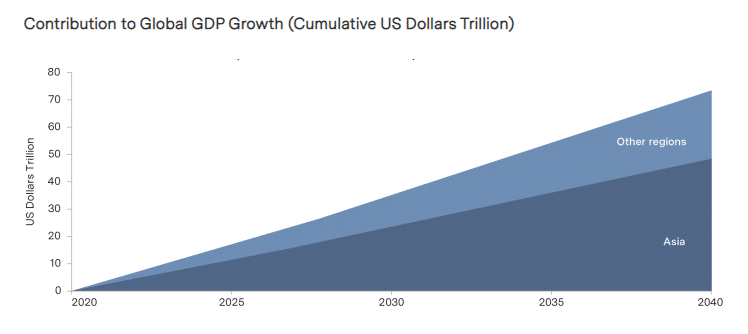

Asia is at an inflection point too important to ignore. It is already the world’s largest economic region and is forecast to deliver around two thirds of global growth over the next two decades.

More importantly, from an investment perspective, the region is also seeing a transition due to the dramatic rise of its middle-class. This is driving a shift in demand, which has historically focused on commoditised products, towards more sophisticated services. We believe that some companies with sustainable competitive advantages in these areas will be able to generate significant earnings growth and valuation expansion. With Asia expected to account for 65% of the world’s middle class by 2030, these trends present opportunities that are too important to ignore.

With this shift, traditional plays on Asian growth, such as Australian resources and materials stocks, may no longer be as effective in gaining exposure to the attractive growth on offer in these markets. We think investors should consider allocations that target Asia’s increasingly sophisticated consumption patterns. Be this in sectors like e-commerce, where some Asian companies are at the forefront of global online consumption trends, or in healthcare, where Asian nations are increasingly able to fund cutting-edge treatment for their vast populations. At VGI Partners, we search for companies that are leveraged to this growth. It is clear to us that an increasing number of the best opportunities globally will be found either in Asia or in companies with high exposure to the region but listed in other markets.

The forefront of e-commerce

Asia already accounts for around 60% of the world’s online retail sales and the regions’ e-commerce consumption story has only just begun.

Given the high propensity towards e-channels, and strong growth in consumption, it is not hard to see where many of the technology giants of the future will be based.

Many of Asia’s key e-commerce markets are dominated by domestic players that have established strong network effects and a sticky customer base. This means investors cannot just rely on Western technology companies to access the Asian growth outlook. To truly understand the regions e-commerce opportunities, investors need to understand the unique nature of each market and be able to assess the risk-reward with a long-term frame of mind.

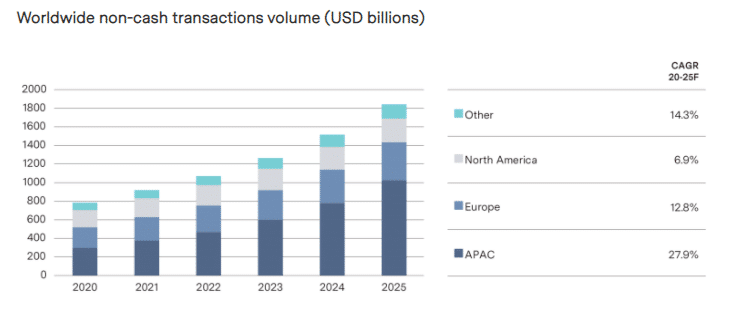

One structural trend we are closely following in the region is the rapid rise in digital payments. Many Asian consumers are embracing payment services offered directly by the e-commerce platforms such as e-wallets and QR-enabled solutions. These services not only bring additional revenue streams for the platforms, from transaction fees, but also enhance their overall fly-wheel effects. With customer rewards and financing options further encouraging consumers to use the e-commerce ecosystem for purchases.

Capgemini forecasts the Asia Pacific region will see growth rates in “non-cash” transaction volumes, which include digital payments, as dramatically outpacing other regions over coming years. We feel the Asian e-commerce platforms that can capture this growth are well placed to generate enhanced earnings growth.

Investors can access growth in Asia via stocks listed in mature markets

Accessing the rising Asian consumer does not necessarily mean investors have to invest in stocks listed in less developed financial markets. Japan, for example, has a highly robust regulatory system and a broad range of listed companies with significant exposure to other rapidly growing Asian economies.

There are other factors that also have us paying particularly close attention to some of these Japanese opportunities. While many Japanese companies have a reputation for providing superior products to their customers, some have been less focused on optimising profit margins for the benefit of shareholders or in paying dividends commensurate with their profits and accrued cash savings.

There is now a clear shift in mindset among Japanese corporates who are increasingly taking shareholders into account. We believe this can unlock value and significantly raise the price of the underlying shares.

Olympus is just one example of a high-quality Japanese company that is well positioned to benefit from a rising Asian middle-class and unlock significant value from shift in mindset towards prioritising shareholders. Olympus is the world leader in gastrointestinal endoscopes, with 70% market share globally. The company has spent decades providing training programs for surgeons on its equipment, in both developed and developing markets.

This has created a sticky customer base of customers that face a high switching cost as shifting to alternative endoscopic equipment would involve time away from the operating table to retrain. As Asia’s middle-class expands, we expect to see a dramatic increase in the number of patients that can afford to receive endoscopic surgery. For perspective, the region is expected to add around one and a half billion people to its middle-class this decade alone.

The full report can be viewed on VGI Partners’ website here, or click below to download the PDF.

Content provided by:

Disclaimer: The information in this document (Information) has been prepared for general information purposes only and without taking into account any recipient’s investment objectives, financial situation or particular circumstances (including financial and taxation position). The Information does not (and does not intend to) contain a recommendation or statement of opinion intended to be investment advice or to influence a decision to deal with any financial product nor does it constitute an offer, solicitation or commitment by VGI Partners.

It is the sole responsibility of the recipient to consider the risks connected with any investment strategy contained in the Information. Neither VGI Partners nor any of its directors, employees, officers or agents accepts any liability for any loss or damage arising directly or indirectly from the use of all or any part of the Information. VGI Partners does not represent or warrant that the Information in this document is accurate, complete or up to date and accepts no liability if it is not.