Content provided by OTG Capital

Written by Ray Trevisan, Director, OTG Capital Pty Limited

Why is security important?

I’m often surprised how many investors take no notice of what is securing their money (aka collateral), when they happily lend it out to any Tom, Dick or Mary investment fund in the form of a Bond, term deposit or fixed income stream.

For me, security is insurance, and is the most important factor in all the considerations I work through when assessing an investment for my mortgage backed fund.

Collateral is what you get back in case your borrower doesn’t pay back the cash they promised to pay you when you loaned them the money in the first place.

For those who have read my Introduction to Bonds previously, you’ll know that a Bond is simply a loan. You are the provider of funds to an investment trust, bank, corporation, property developer or similar – and collateral (or security) is what takes the place of your money if they don’t pay you back.

Secured or Un-Secured?

Rather basic right? A secured loan or bond is something that has collateral, and un-secured doesn’t!

And you will note through the lending market the difference in interest rates for those who borrow with a security in deference to unsecured loans.

But not all collateral is created equal.

And to help you, my 6 tips will assist you (as they do me as a Fund Manager) is assessing whether the collateral is really worth what the borrower says it is.

Tip 1 – Make Sure It’s Real

There are many painful stories of phantom houses, blocks of land that didn’t exist, “good will”, intellectual property or trademarks that aren’t actually owned or really worth anything transferable to cash.

If you’re not sure, do a drive by, check the house is really there, do some desktop research with satellite images. Have an independent valuation done to verify and validate the security’s true worth.

Don't take the borrower's word.

Tip 2 – Future Worth Doesn’t Count Today

Collateral that has future value is not real collateral.

If a block of land is valued at $200k but will be $600k when the sub-division comes through, that’s wonderful!

But for mine, the value is still $200k until the actual sub-division happens.

Any number of things can happen before this event is realised, and should it not happen, you can’t bank future value when it comes to the crunch.

Same applies for “imminent breakthrough”, “pending FDA approval for this wonder drug”, “a huge 10-year procurement contract is due next month” or “when we strike the seam” – they all sound familiar.

Tip 3 – OLV

OLV = Orderly Liquidated Value.

What is the value of something if you have to sell it quickly (and I don’t mean “fire sale”).

In real estate terms, I’m talking 3-6 months to move a property is still reasonably quick, without giving the market messages of desperation. OLV also abides by the long-held rule of real estate value – location, location, location still prevails.

The worst house in the best location will always move quicker than the worst house in the best location.

And consider this if you are being offered a company car, computers or business equipment as collateral for a loan. What is the real value (OLV) if you have to sell it? Will you really get all your money back, or possibly just pennies in the dollar?

A quick check on internet buy/sell/swap sites will let you know the true worth of a computer, furniture or company car. The results often shock and disappoint if you’re the one in a bind trying to get your money back.

Tip 4 – Make Sure They Own It

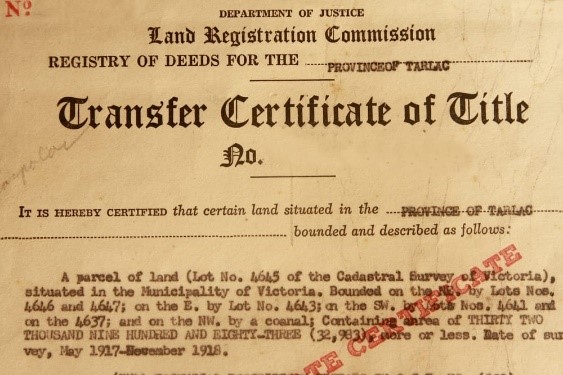

Very much tied to Tip 1, is the collateral real – if a house is being used as collateral, a title search will reveal all you need to know. The owner/s and any encumbrances or caveats on the property are fully spelled out. Make sure the borrower has the right to use the property as security, especially if the title is in joint names – both title owners have to agree.

Same goes for cars, a quick check of the government vehicle register will save many tears later on.

Tip 5 – Validate/Verify for yourself and have a Process

Most people hate contracts as they are the document of last resort when matters go pear shaped.

But my job entails reading them, understanding them and abiding by them. Loans, investment bonds, term deposits are all contracts that provide an investment vehicle for you in which you loan money to someone else, and they pay you back with interest.

Develop and master your own validation / verification process that enables you to ask the right questions and get the answers you need without having to have awkward discussions that start with the other side asking– “Why do you need to check?” or “What don’t you trust me?”

Having a process in place obviates that awkward question every time. You don’t have to question the borrower’s honesty because you’re simply adhering to a proven, long used process, and there are no exceptions.

There’s no excuse for you not to verify and validate that their collateral is real, can be changed for cash in a reasonable time frame, and is actually owned by the borrower and really worth what they say.

Tip 6 – Head Space

Just covering an outstanding loan for its full value is never enough. Having room at the top for additional considerations like legal costs, delays in completion, penalty payments and a safety buffer should the market turn against you is a considered, wise posture to take.

You’ll often see this “head space” quoted or referred to as LVR – loan to value ratio. If you’re lending on a70% LVR, there is 30% head space should something go wrong, or take longer than you anticipated.

Conclusion

Having collateral or security significantly increases the safety of your investment in bonds. While not all collateral is created equal, we hope our quick reference tips will assist you in ensuring your “insurance” is a real plan B should something not go to plan.

Bonds are as safe or dangerous as you make them, having good quality security ensures you won’t get burned even if the market turns.

About the Author

Ray Trevisan is an Authorised Representative (AR:001250963) of Lifestyle Asset Management, who is the holder of an Australian Financial Services License (AFSL:288421). Ray holds a Master of Management from the University of Technology (Sydney), is a Graduate of the Australian Institute of Company Directors (AICD), NSW Justice of the Peace (JP), an accredited Financial Planner (Dip FinPlng) and member of the Financial Planning Association of Australia (FPA).

Ray has a regular radio show & podcast, Dollar$ and Making $ense. He also has over 40 years of business and investing experience and operates the northern beaches office of OTG Capital in Newport Beach, NSW.