The recent rises, and don’t forget the falls, of Bitcoin have thrusted its name, and cryptocurrencies more generally, into the spotlight. Not only are early adopters and technology minded individuals investing but it has also captured the attention of investors more used to conventional assets. This interest has spread to SMSF investors.

What is bitcoin?

Bitcoin (BTC) was built out of the frustration of the Global Financial Crisis in 2008 as a potential form of global currency which is free from central third party intervention. It is a person to person electronic cash system.

Harnessing the technological and communications power we currently have, BTC is built upon a system that ensures there does not need to be a bank that ‘holds’ our value. The system known as blockchain which BTC utilises is a form of electronic record keeping where records are kept by everyone, instead of being kept by a central party, such as a bank. The technology ensures that everybody knows and verifies when a BTC transaction is made with another party. Its utility lies in the fact that transactions and records are incorruptible.

On a side note, it is this blockchain technology which is being utilised by many businesses to decentralise their processes. For example, the ASX will introduce this form of electronic record keeping rather than utilising CHESS holding statements.

Why bitcoin?

Why do individuals think we need a person to person electronic cash system and why are people investing in it? The former is much easier to answer than the latter.

Being borne out of the Global Financial Crisis, individuals were ‘fed up’ with their Governments and financial institutions. The bailouts offered by governments, the recklessness of banks with investor funds and the excessive printing of money to reduce interest rates and purchase distressed assets (the “quantitative easing” that has become part of investors’ vocabulary) brought a group of BTC creators to think there must be a better solution.

In the past decade, some have bought into this premise. Early adopters utilised digital currency to pay for goods and services, most of which were not always legal. Millennials grew comfortable with the idea of a global digital currency, especially those who live in a world where physical fiat currency is hardly used and ‘tap and go’ is so common. Others saw utility in the ability to transfer money to someone across the world for the fraction of cost than traditional banks were offering, others saw value in the blockchain and if you were to ask a Zimbabwean if they saw more long term utility in BTC or their local currency the answer is clear.

Rise to prominence and performance

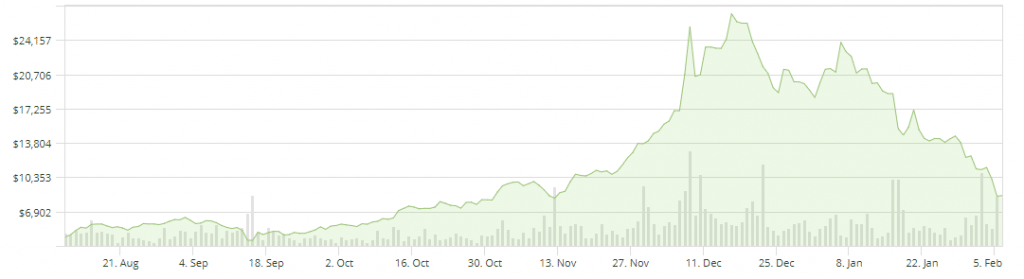

Whilst the original premise of BTC was to make payments as a digital currency seamlessly across the globe, it took on a new lease of life as an investment. As the benefits of BTC were spruiked, the digital currency enjoyed a mammoth rise in investors wanting a piece of the action. Despite its volatility, ability to be ‘duplicated’ by another digital currency and potential lack of intrinsic value the price of BTC has risen remarkably over a short amount of time, leading people to believe it is in a bubble.

(Source: www.btcmarkets.net)

BTC took 873 days to rise from nil to USD $1000. In comparison it took just 4 days to rise from USD $6000 to $USD 7000. Although it isn’t all smooth sailing and guaranteed returns. As seen above, in the past two months BTC has also fallen back to November 2017 prices, shedding 66% of its peak value in 6 weeks, highlighting its extreme volatility.

Bitcoins and SMSFs

Given the recent increase in BTC value, SMSF investors have been attracted to finding out more about BTC and its potential to be stored in an SMSF. Importantly, SMSF laws do not provide a prescriptive list of assets an SMSF can invest in.

As with any investment, it’s extremely important for trustees to know and understand what they are investing in. BTC is a not a get rich quick scheme and its application and utility should be discussed before any investment.

Any prospective investment must also satisfy the ‘sole purpose test’. The sole purpose test ensures that an SMSF is maintained for the sole purpose of providing retirement benefits to members, or to their dependants if a member dies before retirement. How BTC fits into this is debatable, especially given its volatility.

BTC must then be allowable under an SMSF trust deed and investment strategy. Issues such as diversification, liquidity and members’ needs require strong thought to how they apply to BTC. The Australian Taxation Office has stated that BTC is an asset for capital gains tax purposes. They also stated that BTC (in particular) is neither money nor foreign currency. Therefore, trustees would need to update their documentation to include investment in crypto-assets.

SMSF legislation also requires trustees to have a clear separation of assets from assets owned by their SMSF and those in a personal capacity. Purchasing BTC requires a BTC wallet. A wallet is a software program which stores any crypto-assets. At this stage, these wallets are BTC addresses that do not have any name or title on it, so solutions need to be discussed with your approved SMSF auditor to ensure they are satisfied the BTC investment complies with the superannuation laws. Appropriate arrangements can include specific email addresses, specific bank accounts, wallet balance reports and declarations of trusts.

Where to now?

BTC and crypto-assets in general are an unknown commodity in which no one really knows how the story will end. The technology behind it is already being utilised in other areas and the utility of digital currency and assets has many supporters. However, it is almost certain that greater specific crypto regulation will come.

There is no doubt the irrational returns on BTC may force investors to take further positions in the asset but there are also concerns the ‘bubble’ has busted. With SMSF legalisation open to the potential of BTC investment, it’s important to remember just because an SMSF can invest in BTC doesn’t mean it should.

That being said, if BTC investment is right for you and your diversification needs, early engagement with your financial advisor and auditor is essential. Ensuring you pass through all the compliance hoops is crucial to not fall foul of the strict SMSF legislation.

Gain the advice of an SMSF Specialist

We highly recommend that you gain the advice of an SMSF Specialist. To find your nearest SMSF Specialist, use our Find a Specialist function.

Disclaimer: The information contained in this document is provided for educational purposes only, is general in nature and is prepared without taking into account particular objective, financial circumstances, legal and tax issues and needs. The information provided in this article is not a substitute for legal, tax and financial product advice. Before making any decision based on this information, you should assess its relevance to your individual circumstances. While SMSF Association believes that the information provided in this article is accurate, no warranty is given as to its accuracy and persons who rely on this information do so at their own risk. The information provided in this bulletin is not considered financial product advice for the purposes of the Corporations Act 2001.