Content provided by The Perth Mint

Gold was a highly sought after asset class during the Global Financial Crisis (GFC), with the yellow metal outperforming as investors rushed toward this trusted safe haven.

We’ve seen a similar market reaction in 2020, with the price of gold rising by 13% in the first five months of the year.

This article touches on 8 key reasons why demand for gold in the aftermath of COVID-19 is likely to be even stronger than it was during the GFC, and why the yellow metal can play a key role in SMSF portfolios.

1. Health crisis complicates path forward from COVID-19

The GFC was a result of capital misallocation, over indebtedness and excessive leverage in the financial system itself.

Challenging though it was, there was no public health threat complicating the policy response, nor the path out of the crisis. This time around it is a, as yet unresolved, public health threat that has forced a policy response which has led to the economic fallout.

The path forward is more uncertain. After all, we can’t simply legislate or print a vaccine into existence.

2. Debt levels

Total debt levels, especially levels of government debt are much higher today relative to when the GFC hit. According to an April 2020 update from the Institute of International Finance (IIF), global debt levels have now topped USD 255 trillion and are sitting at more than 322% of GDP. That is some 40% higher than when the GFC hit.

There is no doubt that public balance sheets are in an overextended starting position today relative to that of a decade ago.

3. Yields are much lower

Yields are also much lower now relative to the GFC.

Across 2007 and 2008, US 10-year treasury yields averaged 4.10%. On 15 May 2020 the US 10-year yield was sitting at just 0.64%, a decline of almost 85%.

This is important for two reasons.

The first is that governments (and indeed all debtors) have already benefitted from an 85% decline in yields over the last decade, in terms of lower servicing costs on the money they borrow. This tailwind is unlikely to be repeated.

The second reason it’s important is that from an investment perspective, the risk-free return one could earn in treasury bonds during the GFC has turned into return-free risk today, not just in America but around the world.

You will get your money back, but even if today’s historically low inflation rates hold for another decade, it will not have maintained its purchasing power.

The return-free risk also applies at the shorter end of the market too, with cash rates again up against, and indeed in some cases already below, the zero-lower bound.

This is a problem that is particularly acute for SMSF trustees with money in term deposits. During the worst of the GFC, the cash rate in Australia never dropped below 3%. Today the cash rate is just 0.25%.

This means that the opportunity cost of investing in gold is significantly lower in 2020 relative to the GFC environment.

4. Monetary and fiscal policy more expansive

The fiscal response to COVID-19 is also dwarfing what was deployed during the GFC. According to the statistics in this article, the fiscal deficit of all the nations highlighted (when weighted by each nation’s 2009 output) was 4.34% of GDP during the GFC. The same measurement gives us a projected fiscal deficit of 7.34% of GDP in response to COVID-19.

The attitude to unconventional monetary policy is also completely different today. When the GFC hit, QE and zero interest rate policy (ZIRP) were treated as emergency monetary stimulus, to be used with extreme caution and removed as quickly as possible.

It’s worth remembering that QE1, and QE2, involved just USD $600 billion each, whilst QE3 was just USD 40 billion per month. These numbers seem positively quaint today.

It took almost seven years for The Fed balance sheet to grow by USD 3.5 trillion after the GFC hit. This time around the Federal Reserve has added over USD 3 trillion to their balance sheet in just over three months.

Looking forward, questions will remain about the ability of fiat currency to maintain purchasing power, whether it be measured against consumer or financial asset prices.

5. Supply chain issues and trade uncertainty

In the years ahead, trade tensions and supply chain issues companies may encounter in a potentially fragile geopolitical environment are another important distinction between the COVID-19 crisis and the GFC.

In time, this will flow through to either lower company profits, higher inflation, or a combination of the two. These trends can be expected to support gold demand going forward.

6. Commodity prices are much cheaper

Leading into the GFC, commodity prices were high, having outperformed stock prices for most of the early 2000s. Now the situation couldn’t be more different.

Even before COVID-19 hit, commodity prices were at the lower end of their historical range, having fallen by approximately 75% from their all-time highs seen a decade earlier.

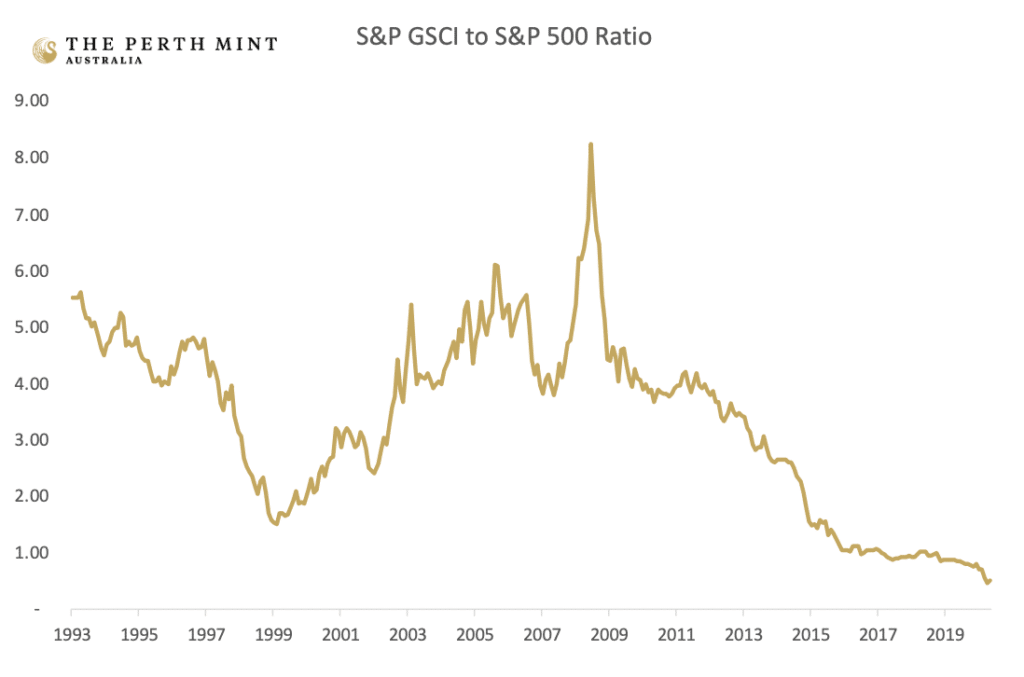

On a relative basis commodity prices have never been cheaper, with the S&P Goldman Sachs Commodity Index to S&P 500 ratio comfortably below 1 today. The chart below shows this ratio was more than 8 when the GFC hit.

Any investor who remotely believes in mean reversion will look at a chart like this and be encouraged by the potential for commodity prices to outperform in the decade ahead.

7. Social impacts

Finally, there are the social elements to consider.

Most investors are at least somewhat concerned at what the ‘post’ GFC world looks like, given it is characterised by ever widening wealth inequality and political fragmentation. COVID-19 has shone an even harsher light on the gap between the haves and the have-nots, with the unease feeding higher gold demand.

Summary

The outlook for gold in the COVID-19 era is arguably even better than it was during the GFC.

The economic threat is more complicated this time around, whilst the geopolitical set up is more fragile, debt levels are higher, interest rates are lower, and equity multiples remain at levels seen prior to the GFC crash.

The end result is that the path toward economic recovery and the outlook for diversified investors is significantly more challenging today than it was just over a decade ago.

These factors, combined with the even more aggressive fiscal and monetary policy in place today are all supportive for gold, with demand likely to be more sustained this time around.

This article is an edited extract from a piece published at Livewire Markets.

Content provided by:

Disclaimer: Past performance does not guarantee future results. The information in this presentation and the links provided are for general information only and should not be taken as constituting professional advice from The Perth Mint. The Perth Mint is not a financial adviser. You should consider seeking independent financial advice to check how the information in this article relates to your unique circumstances. All data, including prices, quotes, valuations and statistics included have been obtained from sources The Perth Mint deems to be reliable, but we do not guarantee their accuracy or completeness. The Perth Mint is not liable for any loss caused, whether due to negligence or otherwise, arising from the use of, or reliance on, the information provided directly or indirectly, by use of this resource.