Written by Paul Miron, Managing Director, Msquared Capital

It is time to say it – Enough is Enough! We do not need any more rate increases!

The official RBA Cash Rate has increased for the 10th consecutive time – unprecedented in our modern economic history. We have now reached a stage where it is becoming unnerving as to when our path of rate increases will halt. More disturbingly, this is happening worldwide – not just in Australia. Central bankers are becoming unhinged and seem to disregard the inevitable financial consequences of a recession as long they win the short-term battle against the unfriendly foe of inflation.

As former US President Ronald Reagan, famously said, “Inflation is as violent as a mugger, as frightening as an armed robber, and as deadly as a hitman.”2 That being said, despite the evils of inflation, caution still needs to be taken when raising rates so as to not break the economy.

The most recent data shows that the worst fears of the wage-price inflationary spiral have not materialised and that inflation on goods is moderating. Inflation on services and rent is now forming the battleground’s main front line in the fight against inflation, and the weapon of choice should not be higher interest rates. It only further adds fuel to the inflation fire.

All of this is to reiterate – we do NOT need an 11th consecutive interest rate increase.

Want to continue raising rates? How about driving a car blindfolded?

The full effect of the current interest increase will impact thousands of mortgage holders, generally young working families and small businesses, who will be hit the hardest.

To crystallise this point, let us look at some figures. The average mortgage rate was just under 2% p.a. a year ago, with an average mortgage in NSW being $750,000 on a 25-year term.3 With this week’s increase and the average mortgage rate now being 5.5% p.a, the result is a 45% increase in monthly repayments. Looking at the core data, it is safe to assume we have not witnessed the ramifications of this increase, such as a reduction in discretionary spending and the undesirable structural changes to come. This is especially so as many households are burning through the excess savings hoarded during the government’s generous financial assistance schemes during the COVID-19 pandemic.

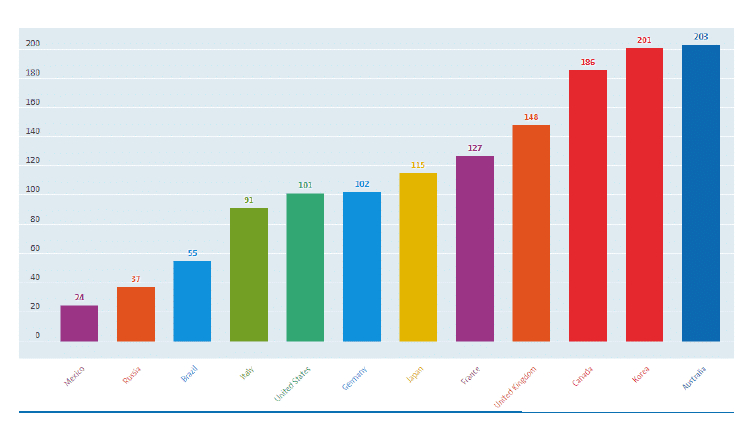

It is no secret that Australian households are some of the most indebted in the world. Therefore, they are more sensitive to these rate rises than their global peers. Thus, great caution needs to be exercised at this critical juncture.

As much as increasing interest rates is unpopular, it is not easy to execute and needs to be more dynamic to make an impact in the short term. We are witnessing month-to- month critical key data, missing targets and expectations, such as retail spending, inflation, unemployment, GDP growth and wage inflation. The key question is whether we should rely solely on blunt monetary policy, and whether or not more must be done on the side of fiscal policy to help curb inflation.

There needs to be a plan B in place too. We must look past Robin Hood tax policies and focus on the fundamentals – increasing productivity and tackling more significant issues that may hinder future growth, such as our tax system as per the Henry Tax Review, removing the red tape and bureaucracy, and generating real incentives for businesses to grow and invest.

Where should long-term interest rates be set? What is the likely trajectory from here?

Governor Philip Lowe of the RBA has provided insights into what he believes to be Australia’s neutral official cash rate, being 2.75% p.a. In contrast, the current official cash rate neither stimulates the economy (by providing excess support to the supply of money) nor contracts it. We are far beyond the neutral cash position of 2.75% p.a, with economic indicators recently showing signs of changes to headline inflation, spending, unemployment, and GDP growth.

The 2.75% p.a. neutral cash rate assumption provides a logical rationale to assume this would be the ideal cash rate set once inflation is controlled. It justifies reducing the official cash rate to allow the economy and property market to return to normality. This forms the basis of the financial market’s primary argument that central bankers will certainly overshoot interest with a higher rate in the short term and will be forced to decrease rates once the inflation battle is won.

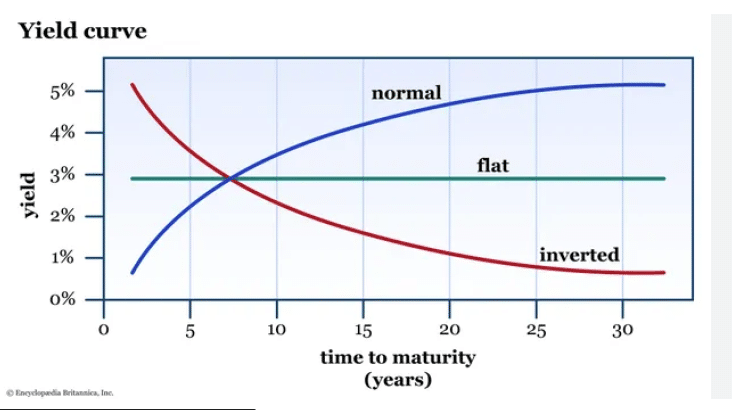

This logic makes a recession much more probable, with the critical question being at what cost and whether there is a better way to manage rates. The assumption is now reflected in the long-term money market, where the yield curve is inverted for the first time in years, with interest rates to increase during 2023 and fall promptly rather than later once unemployment and GDP growth start scaring both the market and RBA Board.

Alarmingly, there needs to be more conversation regarding a possible ceiling of the official cash rates before the economy unnecessarily enters territory that may cause long-term economic damage.

One of the greatest economists (whose life work was the study of inflation), Milton Friedman, conducted research which concluded that there is a 6-9 month lag between the beginning of interest rate hikes and the ultimate impacts on the economy. This provides the best rationale for an immediate pause to official cash rates for at least six months before any further changes to the official cash rate.3

Ultimately whether it is 6 to 18 months, official cash rate will ultimately be lowered closer to 3% p.a, albeit unforeseen black swan events.

To read Msquared Capital’s full article on rate hikes please click below to download the report.

Content provided by:

Disclaimer:

Msquared Capital Pty Ltd ACN 622 507 297, AFSL No. 520293 (Msquared) is the Trustee of Msquared Contributory Mortgage Income Fund.

The information contained on this website should be used as general information only. It does not take into account the particular circumstances, investment objectives and needs for investment of any investor, or purport to be comprehensive or constitute investment advice and should not be relied upon as such. You should consult a financial adviser to help you form your own opinion of the information, and on whether the information is suitable for your individual needs and aims as an investor. You should consult appropriate professional advisers on any legal, stamp duty, taxation and accounting implications of making an investment.

The information is believed to be accurate at the time of compilation and is provided by Msquared in good faith. Neither Msquared nor any other company in the Msquared Group, nor the directors and officers of Msquared make any representation or warranty as to the quality, accuracy, reliability, timeliness or completeness of material on this website. Except in so far as liability under any statute cannot be excluded, Msquared, its directors, employees and consultants do not accept any liability (whether arising in contract, tort, negligence or otherwise) for any error or omission in the material or for any loss or damage (whether direct, indirect, consequential or otherwise) suffered by the recipient of the information or any other person. The information on this website is subject to change, and the issuer is not responsible for providing updated information to any person. The information on this website is not intended to be and does not constitute a disclosure document as those terms are defined in the Corporations Act 2001 (Cth). It does not constitute an offer for the issue sale or purchase of any securities or any recommendation in relation to investing in any asset.

Investors should consider the Fund’s Constitution, Information Memorandum (IM) and relevant Loan Memorandum (disclosure documents) containing details of investment opportunities before making any decision to acquire, continue to hold or dispose of units in the Fund. You should particularly consider the Risks section of the Information Memorandum and relevant Loan Memorandum. Anyone wishing to invest in a Msquared Contributory Mortgage Income Fund will need to complete an Application Form. A copy of the IM and related Application Form may be obtained from our office via email request from [email protected].

Past performance is not indicative of future performance. No company in the Msquared Group guarantees the performance of any Msquared fund or the return of an investor’s capital or any specific rate of return. Investments in the Fund’s products are not bank deposits and are not government guaranteed. Total returns shown for Msquared Contributory Mortgage Income Fund have been calculated net of fees and any distribution forecasts are subject to risks outlined in the disclosure documents and distributions may vary in the future. All figures and amounts displayed in this email are in Australian dollars. All asset values are historical figures based on our most recent valuations.

The information found on this website may not be copied, reproduced, distributed or disseminated to any other person without the express prior approval of Msquared.