2022 RESEARCH

The SMSF Association has engaged the University of Adelaide to explore the relationship between fund size and investment performance of self-managed super funds (SMSFs) and APRA-regulated funds, titled ‘Understanding self-managed super fund performance’.

This research venture used SMSF financial statement data from over 50% of the SMSF population and a calculation method APRA uses to calculate returns, to identify a more realistic picture of the minimum fund balance an SMSF needs to achieve comparable investment returns with much larger funds.

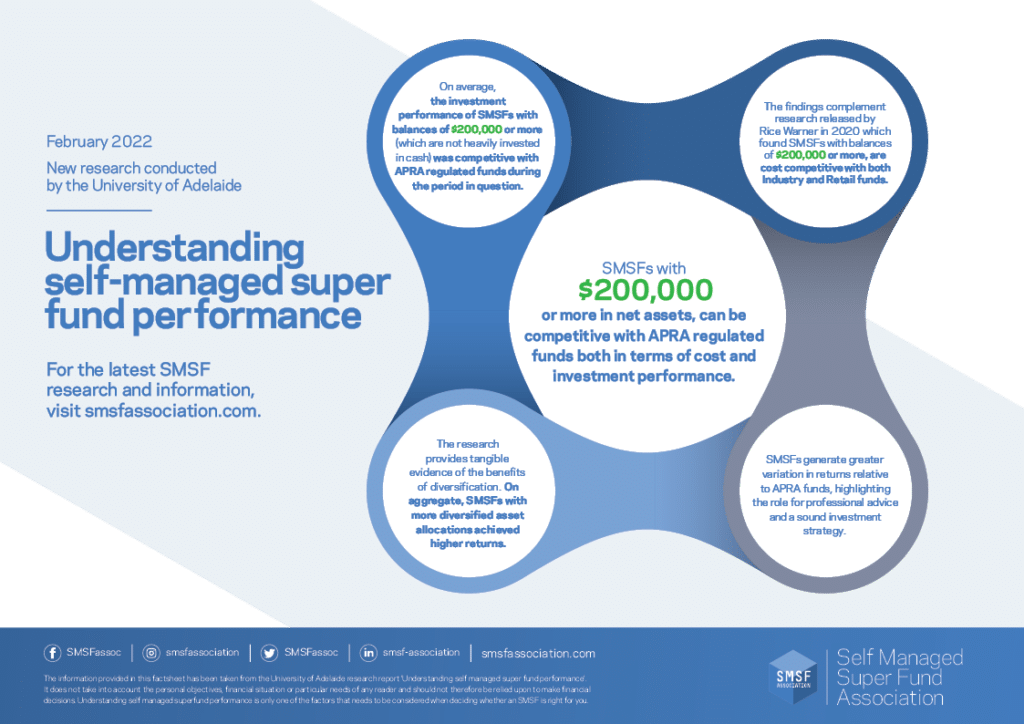

Coupled with a diversified asset allocation, the research findings support the notion that the threshold at which SMSFs start to see improvement in investment returns is $200,000.

Although SMSFs are not for everyone, this research is good news for individuals who have the time and expertise, and want control over their retirement savings.

Discover more about the 5 key research findings in the factsheet and report summary below, that should be considered by current SMSF trustees, or those individuals who are discussing their super options with an accredited SMSF Specialist.

KEY RESOURCE

Fact Sheet: 5 Key Findings

A one-page document that showcases the 5 key research findings, written in easy-to-understand language tailored to SMSF trustees about the ‘Understanding self-managed super fund performance‘ research.

KEY RESOURCE

Report Summary

A high-level summary about key research findings with accompanying SMSF Association commentary.

KEY RESOURCE

Academic Paper

Academically written report outlining the full methodology and calculations used to discover key research findings.

In the Media

SMSF Association Media Release

The investment performance of a typical self-managed super fund (SMSF) improves as the fund balance approaches $200,000. Once this threshold is reached the fund achieves comparable investment returns with APRA regulated funds, according to comprehensive research released today by the University of Adelaide’s International Centre for Financial Services (ICFS).

New research released on Tuesday (15 February) by the University of Adelaide revealed that the investment performance of a typical self-managed super fund (SMSF) improves as the fund balance approaches $200,000.

SMSFs that had assets above $200,000 and were not concentrated in cash and term deposits had performance on par with Australian Prudential Regulation Authority (APRA)-regulated funds, according to new research commissioned by the SMSF Association.

First published in Financial Review on 23 February 2022. Licensed by Copyright Agency.

The latest research into SMSF investment returns has revealed significant holdings in one particular asset class was the common denominator in funds that showed underperformance compared to their Australian Prudential Regulation Authority (APRA)-regulated counterparts.

There is a strong case for new consumer guidance about the costs and performance of SMSFs to be produced and distributed by the Australian Securities and Investments Commission (ASIC), according to the SMSF Association.

SMSF Association Media Release

The SMSF Association welcomes adjustments made by the Australian Tax Office (ATO) to align their SMSF performance calculations more closely with the methodology used by the Australian Prudential Regulation Authority (APRA) to calculate returns for APRA-regulated funds.

Adjustments to the ATO’s calculation of SMSF performance to further align with the methodology used to calculate returns for Australian Prudential Regulation Authority (APRA)-regulated funds have been welcomed by the SMSF Association, a week after it released its own performance data.

The ATO will align SMSF performance calculations more closely with APRA-regulated funds after research found they were not being fairly compared.

Related Research

2021-2022 SMSF Performance

Released in 2024, this annual research showed the SMSF sector outperformed the APRA fund sector during the 2021-2022 financial year. This research contributes to the existing evidence on the strong financial performance of the SMSF sector.

2020-2021 SMSF Performance

Released in 2023, this this research builds upon the 2022 research which explored the relationship between fund size and investment performance, between both SMSFs and APRA-regulated funds.

Cost of Operating SMSFs 2020

Released in 2020, this research examines the size at which an SMSF becomes a viable option for those who are considering establishing an SMSF or are continuing to use an SMSF for their retirement savings.

About SMSF Connect

If you have a self managed super fund (SMSF) or are thinking of setting one up, SMSF Connect aims to empower you to self-educate and take greater control over your destiny in achieving a dignified retirement.

We understand that education leads to greater knowledge and the ability to make more informed decisions. Take charge of your future with SMSF Connect, your comprehensive education resource for your SMSF.

SMSF Connect includes up to date information on the latest SMSF and superannuation news, education resources, checklists, information sheets, events, webinars, videos and more.

SMSF CONNECT FREE COMMUNITY

Join the Community

Being a part of the SMSF Connect community positions you at the forefront of the latest self managed super fund information, empowering you with the tools to seek the best outcomes on your SMSF journey.