Written by Paul Miron, Managing Director, Msquared Capital

Amidst a war in Eastern Europe, our central bank is grappling with the impacts of a rising cost of living, a severe energy crisis (not experienced since the 1970s), official inflation hitting 3.5%, and lastly, COVID-19 and its variant accomplices. This is not to mention the constant heartaches inflicted by fires and floods over the past three years and their financial implications on the economy.

Thus, we must ask ourselves – how will this impact everyday Australians? What will be the effect on interest rates, property prices and the general economy?

The RBA Governor’s message to mortgage holders last Friday 10 March 2022 has been much more sobering than previous statements – “Mortgage Holders should start preparing for interest rate increases.” In our view, we had been lulled into a false sense of security that low-interest rates were here to stay, at least until 2024. However, the financial markets are now factoring up to 5 increases this year alone, with more to follow in 2023. The experts predict increases in official cash rates totalling 1.5% between now and Christmas next year. The first of these increases will be the first increase in official cash rates since November 2010.

Even the most optimistic property pundits understand that rate hikes will challenge future price appreciation and signal an inflexion point leading to property prices falling. Moreover, these anticipated rate increases will have broader ramifications on other asset prices and the wider economy.

The Federal Government and the RBA are trying to balance on a precarious tightrope as they gradually taper economic support and raise interest rates, whilst not beating the economy into a recession.

Despite these significant economic challenges, especially the inevitable withdrawal of free money, Australia is once again better-equipped than its international peers in dealing with these challenges, with Australia’s mineral-rich economy being a benefactor of high energy prices. This advantage in selling minerals also acts as an inflation hedge in a world of rising prices. In addition, having immigration as part of our export mix effectively cushions the economy and limits labour constraints, while improving our national GDP figures and fending off stagflation fears.

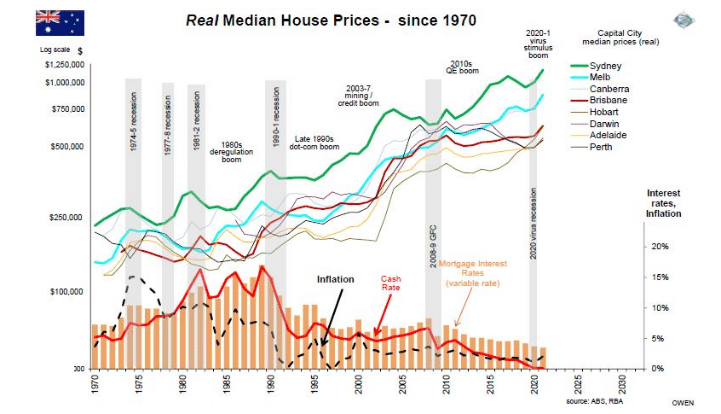

I guess the million-dollar question (or more like, the $1.6 million question in Sydney – or $1.1 million question in Melbourne) is “How far will property prices fall over the next 12 months?”

As Albert Einstein once said, “If you want to know the future, you need to look into the past”.

On 6 March 2019, the RBA Governor presented at the AFR business summit. As can be seen in the graph below, the benefit of hindsight lays out the foundation and justifications for future rate reductions for the sole reason of increasing property prices. Looking at the benefits of property price appreciation, a 10% increase in property prices would increase consumer spending by circa 1.5% (Keynesian Wealth effect) to give the economy some additional stimulus.

It is essential to note this was all whilst property prices took an 18% hit in 2018 – it was not due to a lack of demand; it was induced by APRA’s intervention combined with the Banking Royal Commission which restricted bank finance and the flow of capital to buy property.

It was not too long after these events that interest rates began to decrease from the 1.5% official cash rate, with the RBA Governor uttering one of the most important quotes in regards to property prices. He believed that property prices could go up as high as 30% without being a risk to the general economy.

Remember, this was during a time when most property economists believed property prices would fall between 20%-30%.

Indeed, since this statement, property prices have increased by 30% over the 18 months, nationally.

To read more about Msquared Capital’s property predictions, click below to download the full report: Property – A reliable asset in uncertain times.

Content provided by:

Disclaimer:

Msquared Capital Pty Ltd ACN 622 507 297, AFSL No. 520293 (Msquared) is the Trustee of Msquared Contributory Mortgage Income Fund.

The information contained on this website should be used as general information only. It does not take into account the particular circumstances, investment objectives and needs for investment of any investor, or purport to be comprehensive or constitute investment advice and should not be relied upon as such. You should consult a financial adviser to help you form your own opinion of the information, and on whether the information is suitable for your individual needs and aims as an investor. You should consult appropriate professional advisers on any legal, stamp duty, taxation and accounting implications of making an investment.

The information is believed to be accurate at the time of compilation and is provided by Msquared in good faith. Neither Msquared nor any other company in the Msquared Group, nor the directors and officers of Msquared make any representation or warranty as to the quality, accuracy, reliability, timeliness or completeness of material on this website. Except in so far as liability under any statute cannot be excluded, Msquared, its directors, employees and consultants do not accept any liability (whether arising in contract, tort, negligence or otherwise) for any error or omission in the material or for any loss or damage (whether direct, indirect, consequential or otherwise) suffered by the recipient of the information or any other person. The information on this website is subject to change, and the issuer is not responsible for providing updated information to any person. The information on this website is not intended to be and does not constitute a disclosure document as those terms are defined in the Corporations Act 2001 (Cth). It does not constitute an offer for the issue sale or purchase of any securities or any recommendation in relation to investing in any asset.

Investors should consider the Fund’s Constitution, Information Memorandum (IM) and relevant Loan Memorandum (disclosure documents) containing details of investment opportunities before making any decision to acquire, continue to hold or dispose of units in the Fund. You should particularly consider the Risks section of the Information Memorandum and relevant Loan Memorandum. Anyone wishing to invest in a Msquared Contributory Mortgage Income Fund will need to complete an Application Form. A copy of the IM and related Application Form may be obtained from our office via email request from [email protected].

Past performance is not indicative of future performance. No company in the Msquared Group guarantees the performance of any Msquared fund or the return of an investor’s capital or any specific rate of return. Investments in the Fund’s products are not bank deposits and are not government guaranteed. Total returns shown for Msquared Contributory Mortgage Income Fund have been calculated net of fees and any distribution forecasts are subject to risks outlined in the disclosure documents and distributions may vary in the future. All figures and amounts displayed in this email are in Australian dollars. All asset values are historical figures based on our most recent valuations.

The information found on this website may not be copied, reproduced, distributed or disseminated to any other person without the express prior approval of Msquared.