The SMSF Association has welcomed the Productivity Commission’s decision to follow our recommendations to improve SMSF advice standards and reject introducing minimum establishment balances as a way of ensuring the integrity of the SMSF sector.

The Productivity Commission’s report into Superannuation was handed to the Australian Government on 21 December 2018 and publicly released yesterday. The report assesses the efficiency and competitiveness of Australia’s superannuation system and whether better ways to allocate defaults are needed.

The Commission released 31 findings in relation to improving the Superannuation system. To read more about the Commission’s findings, click here.

Key points include:

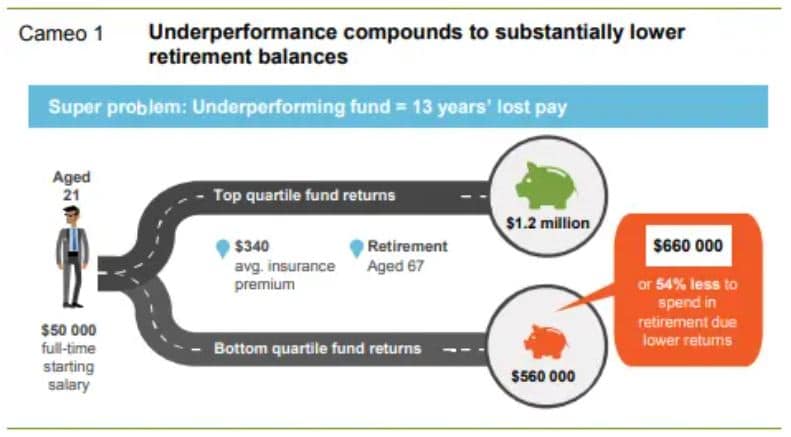

- Australia’s super system needs to adapt to better meet the needs of a modern workforce and a growing pool of retirees. Structural flaws — unintended multiple accounts and entrenched underperformers — are harming millions of members, and regressively so.

- Fixing these twin problems could benefit members to the tune of $3.8 billion each year. Even a 55 year old today could gain $79 000 by retirement.

A new job entrant today would have $533 000 more when they retire in 2064.

- Fixing these twin problems could benefit members to the tune of $3.8 billion each year. Even a 55 year old today could gain $79 000 by retirement.

- Assessment of the super system reveals mixed performance.

- While some funds consistently achieve high net returns, a significant number of products underperform, even after adjusting for differences in investment strategy. Underperformers span both default and choice, and most (but not all) affected members are in retail funds.

- Evidence abounds of excessive and unwarranted fees in the super system. Compelling cost savings from realised scale have not been systematically passed on to members as lower fees or higher returns.

- A third of accounts (about 10 million) are unintended multiple accounts. These erode members’ balances by $2.6 billion a year in unnecessary fees and insurance.

- The system offers products that meet most members’ needs, but members lack simple and salient information and impartial advice to help them find the best products.

- Not all members get value out of insurance in super. Many see their retirement balances eroded — often by over $50 000 — by duplicate or unsuitable (even ‘zombie’) policies.

The Commission’s main recommendation included members being defaulted once, and move to a new fund only when they choose and allowing members to choose their own super product from a ‘best in show’ shortlist, set by a competitive and independent process.

In relation to SMSF performance, the Commission stated the following:

- “As a whole, the SMSF segment delivered annual returns (less fees and taxes) of about 5.7 per cent a year over the 11 years to 2016, compared with 5.3 per cent for the APRA-regulated segment over the same period. This difference in performance could be driven by superior investment performance by SMSFs within asset classes, by differences in the underlying asset allocation between the segments, or by differences in how returns data are collected and reported by the ATO and APRA.

However they found:

- The SMSF segment has delivered broadly comparable investment performance to the APRA-regulated segment, but many smaller SMSFs (those with balances under $500 000) have delivered materially lower returns on average than larger SMSFs.

The SMSF Association is pleased the Commission has taken its submissions on board in relation to SMSF investment return and cost data. $500,000 is a significant reduction from the $1 million dollars suggested in the Commission’s original draft finding. This is a more realistic figure to use as a guide for discussing SMSF appropriateness but as the Commission noted, there are many high performing SMSFs with balances below this figure.

Furthermore, they agreed with the Association that a minimum balance requirement is too blunt an instrument, recognising there are many reasons an SMSF can be established with lower balances. However, they believe advisers should be prepared to justify to ASIC why they are recommending any SMSF be established with a balance remaining under $500 000 beyond the initial establishment years.

Their only recommendation in relation to SMSFs and financial advice related to stronger safeguards on SMSF advice, including:

- require specialist training for persons providing advice to set up an SMSF

- require persons providing advice to set up an SMSF to give prospective SMSF trustees a document outlining ASIC’s ‘red flags’ prior to establishment

The Association strongly supports that any financial advisers that want to advise SMSF members should have undertaken specialist SMSF advice education or accreditation in order to lift the quality of SMSF advice.

Raising the standards of SMSF advice through specific education requirements has long been the mantra of the SMSF Association and a key focus of our mission to lead the professionalism, integrity and sustainability of the SMSF sector. The need to ensure SMSF advice providers are appropriately educated is now supported by both ASIC and the Productivity Commission.