Content provided by The Perth Mint

“Bull markets are born on pessimism and die on euphoria” – John Templeton

Irrespective of whether you think Bitcoin is a Ponzi scheme, the future of money, or something in between, there is no doubting it is again frontpage financial news.

Prices rose to more than USD 60,000 per coin in April, helped in no small part by the news that Tesla invested USD 1.5 billion into the cryptocurrency.

From early March 2020, when it was trading below USD 5,000, the bitcoin price rallied more than 1000%, though it then underwent a major correction, falling more than 50% in the next three months.

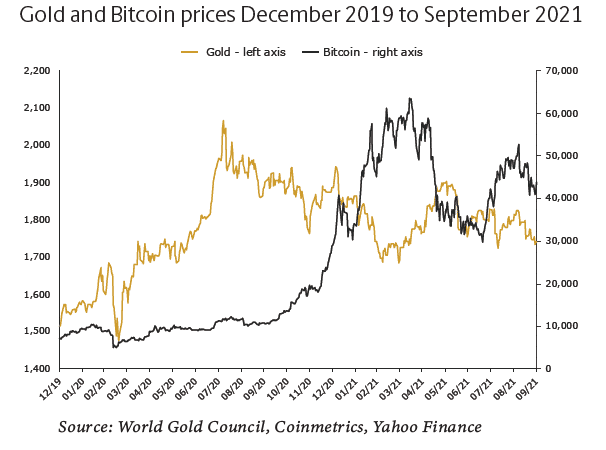

Interestingly, the skyrocketing price of bitcoin has more or less coincided with a meaningful pullback in gold (see chart), which had traded at all-time highs above USD 2,000 per troy ounce in August 2020.

Given the divergent fortunes of the two assets in the past year, there are now some commentators stating that the precious metal is being usurped by its purported digital counterpart, with some going so far as to encourage investors to drop gold and reallocate to bitcoin instead.

Our detailed research report, Gold, Bitcoin and the Elon effect, released earlier this year, questions the wisdom of this narrative, not least because of the multiple bubble warning signs evident in cryptocurrency markets today.

These include the parabolic price move itself, the launch of bitcoin ETFs and planned IPOs of cryptocurrency exchanges, while it is hard to think of a more euphoric moment than the world’s richest man using company money to invest in this nascent asset class.

Despite those warnings, we have no strongly held view on where the bitcoin price goes from here, and it must be acknowledged that as a market, it has matured since the last mania seen in 2017. There is now better transparency around liquidity data, enhanced custody solutions, and a range of new product offerings, all of which are helping generate interest from institutional investors.

As such, our report merely aims to highlight the multiple attributes by which investors can, and indeed should, compare gold and bitcoin, which remain two vastly different investments. With one notable exception, gold would appear to have a handful of advantages that the world’s most famous cryptocurrency will never catch.

Content provided by:

Disclaimer: Any opinions expressed in this article are subject to change without notice. The information in this article and the links provided are for general information only and do not contain all information that may be material to you making an investment decision. The Perth Mint is not a financial adviser and nothing in this article constitutes financial, investment, legal, tax or other advice. Before making an investment decision you should consider whether it is suitable for you in light of your investment profile, objectives, financial circumstances and the merits and risks involved. You should consider seeking independent financial advice to check how the information in this article relates to your unique circumstances. All data, including prices, quotes, valuations and statistics included have been obtained from sources The Perth Mint deems to be reliable, but have not been independently verified by The Perth Mint and we do not guarantee their accuracy or completeness. The Perth Mint does not accept any liability, including without limitation any liability due to any fault, negligence, default or lack of care on the part of The Perth Mint, for any loss arising from the use of, reliance on, or otherwise in connection with the information contained in this article.