Content provided by The Perth Mint

As with all managed funds, gold ETFs incur costs and fees charged to their investors to cover the expenses of operating the product on a regulated exchange.

Unlike most other ETF products, which tend to have some cash in them as part of the portfolio of assets owned on behalf of investors, gold ETFs don’t have much, and in some cases, don’t hold any cash at all.

This is by design, as gold ETFs are designed to track the gold price and must, therefore, be fully invested in gold.

To charge a fee, gold ETFs typically build in a daily reduction to the metal entitlement that each unit, share or option (not all gold ETFs follow the same legal structure) provides to each investor.

By reducing the metal entitlement, the gold ETF issuer can then effectively use the gold it has ‘taken’ to pay the management fee the investors owe.

For example, if we assume a gold ETF entitled an investor to one troy ounce of gold for every unit they bought on the day the gold ETF was launched, and the gold ETF had a management fee of 1% per annum, then after one year the metal entitlement of that one unit would be 0.99 troy ounces of gold.

If we also assume that the gold price was AUD 2,500 per troy ounce on the day it was launched, and was still worth AUD 2,500 one year later, then the price the gold ETF would trade in the market on these two days would look like this:

Don’t lose returns on fees

Costs are a critical factor for investors to consider as the trading spreads incurred when buying and selling an asset, as well as ongoing management fees, eat away at the returns generated.

One of the advantages of gold ETFs is that they are inexpensive both from a management fee, as well as a trading cost perspective.

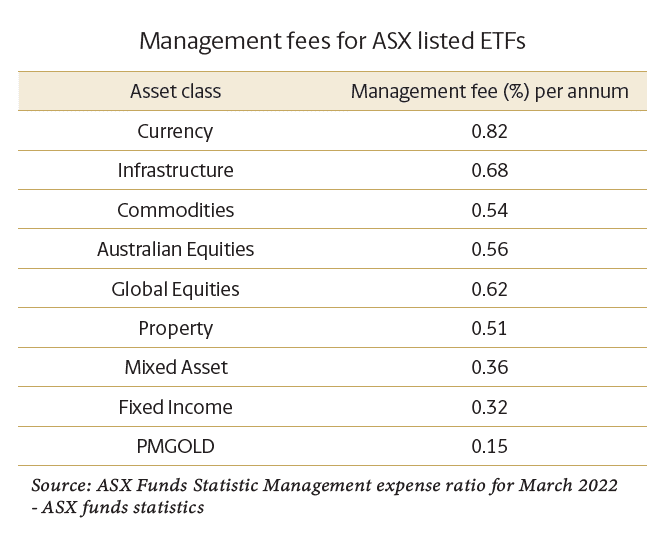

This can be seen in the accompanying tables which highlight the management fees and trading spreads of a variety of ETFs available through the Australian Securities Exchange (ASX), including The Perth Mint’s ETF ASX:PMGOLD.

This table highlights the fact that the Perth Mint’s gold ETF is at the very low end of the cost range, with management fees that are much less expensive than nearly every asset class available to investors via an ASX listed ETF.

It is not just management fees where gold ETFs are at the lower end of the cost range.

The low costs associated with The Perth Mint gold ETF (PMGOLD) is obviously beneficial to investors who will get to keep more of the return generated by the gold for themselves, rather than paying it away in product fees.

It’s not just the management fees that are low, the benefits of a gold ETF through The Perth Mint also includes a guaranteed backing from the Government of Western Australia. These are the only government-backed ETFs in the world.

To find out more about The Perth Mint’s gold ETF (ASX:PMGOLD), please visit The Perth Mint website here, or click below to download the report.

Content provided by:

Disclaimer: Any opinions expressed in this article are subject to change without notice.

The information in this article and the links provided are for general information only and do not contain all information that may be material to you making an investment decision.

The Perth Mint is not a financial adviser and nothing in this article constitutes financial, investment, legal, tax or other advice.

Before making an investment decision you should consider whether it is suitable for you in light of your investment profile, objectives, financial circumstances and the merits and risks involved. You should consider seeking independent financial advice to check how the information in this article relates to your unique circumstances.

All data, including prices, quotes, valuations and statistics included have been obtained from sources The Perth Mint deems to be reliable, but have not been independently verified by The Perth Mint and we do not guarantee their accuracy or completeness.

The Perth Mint does not accept any liability, including without limitation any liability due to any fault, negligence, default or lack of care on the part of The Perth Mint, for any loss arising from the use of, reliance on, or otherwise in connection with the information contained in this article.