Written by Mark Pey, Director and Co-Founder, Rush Gold

Declining values for paper-based assets like shares and bonds might be making physical assets such as gold and other commodities more appealing. But if you seek to hold gold bullion, make sure you keep the regulators onside (of which more later).

Recent market news has shown how volatile paper-based assets can be. Reserve Bank of Australia (RBA) Governor Philip Lowe recently warned the nation to prepare for substantial interest rate rises this year. He believes inflation could reach seven per cent by December while interest rates could reasonably reach about 2.5 per cent. Currently, the RBA Cash Rate is 1.35 per cent.

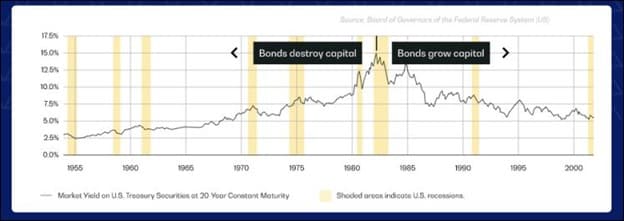

In that environment, as inflation forces central banks such as the US Federal Reserve to raise interest rates, bonds are switching from being capital growth assets to being capital destruction assets.

For decades, investors relied on the so-called 60/40 portfolio – a mix of 60 per cent shares and 40 per cent bonds, or something close to it – to generate enough stable growth and steady income to meet their financial goals. Many financial commentators now question that view, based on economic conditions looking forward.

If you have a self-managed super fund (SMSF), it’s likely that you own shares and possibly bonds, but you may wish to consider owning other assets. You can diversify your portfolio beyond shares and bonds with other assets outside global share markets and even with assets that are outside the banking system, which looks to be entering an instability phase like the GFC.

You can invest in commodities such gold and silver indirectly through investing in mining shares, gold and silver exchange-trade funds (ETFs) – a basket of securities that tracks an underlying index – or a managed fund. But with a physical asset such as gold, you can wholly own and hold the metal in your hands if you want, with minimal management fees.

If you have an SMSF, you have done that because you want more control over your super. So why not buy gold directly?

The regulators oversee special rules to prevent fraud and mismanagement, which will require extra documentation. But if you are prepared for that level of accountability, your SMSF is probably the most appropriate instrument for controlling your super in retirement.

As a starting point it is necessary to ensure both your trust deed and investment strategy allow you to hold this type of asset. If not, you will need to have these documents updated to allow for this acquisition before proceeding.

As trustee you can invest in physical gold providing it is not purchased from a related party. When you buy gold bullion bars or gold ingots you are responsible for storage and protection, and the insurance of the gold is in the SMSF’s name. Oversight of the purchase and sales documents of the gold investments is also the trustee’s responsibility.

As an alternative, you can purchase bullion online and have the seller manage the insurance and storage. When you buy gold online, look for providers who meet the standard rules maintained by the top global gold organisations. The most reputable companies provide gold that is certified by the London Bullion Metals Association.

Also, when buying online, ensure you have the actual rights to the gold. You should be able to get funds in and out of your account quickly and easily. Use a payment method you trust so you can receive funds to your bank account anywhere in the world when you sell your gold. It should be easy to buy and sell any amount of your gold at any time.

One thing you want to avoid while investing in gold is the Australian Taxation Office’s ruling on collectables and personal use assets. Gold and silver bullion coins are collectables if their value exceeds their face value and they are traded at a price above the spot price of their metal content. Precious metals such as gold, silver or platinum bullion are typically not considered a collectable where the value is primarily influenced by the weight of the precious metal.

Recently there were reports that the home storage of commodity gold was facing greater scrutiny from auditors, who were raising concerns about the existence of the precious metal. They want more robust forms of audit evidence rather than statutory declarations or a photo of the gold with a newspaper. Apparently, auditors are seeking more qualifications for commoditised gold stores in places that cannot be independently verified from statements originating from a mint or an online exchange. If in doubt about your situation, get professional advice.

Content provided by:

Disclaimer:

The information contained in this article is general information only. Any advice is general advice only. Neither your personal objectives, financial situation nor needs have been taken into consideration. Accordingly you should consider how appropriate the advice (if any) is to those objectives, financial situation and needs, before acting on the advice.