Written by the Rush Gold Team

The current banking crisis, coupled with declines in equities, bonds and certain property valuations have markets on edge. SMSF investors, in particular, are wondering how to get confidence and stability back in their portfolios.

Investors are also seeking information not only about their investments, but also about the stability of currencies themselves, especially where the value of many are declining due to inflation.

A changing world

We have been used to a world where government-backed currencies were considered a stable store of value and measure for transacting. The US dollar has been the global reserve currency for a century. Quoting products and services in U.S. dollars has been an effective communication and valuation tool across global trade, commerce, infrastructure and investing.

However, recent events in banking and geopolitics are beginning to diminish the perceived ‘stability’ of this economic cornerstone.

The full scope of these events is still unfolding but investors are monitoring:

- The ongoing crisis around SVB, Signature Bank, Credit Suisse & Deutsche Bank and the wider banking industry, which began with SVB’s unhedged Treasury Bonds losing value.

- The movement of capital from smaller regional banks towards giants of the industry, such as JP Morgan.

- The shortfall between the U.S. Federal Deposit Insurance Corporation reserves (approximately $128B), and the U.S. banking deposits it exists to guarantee (around $17.5T).

- The dramatically varying size of the Federal Reserve balance sheet, as the U.S. has switched from quantitative easing to tightening and back to easing again.

- The size of the US debt (over $30T) and the revelation that around 20-25% of all taxes harvested are used to pay only the interest on that debt.

- The possibility that the only way out of this dilemma is to print enough dollars to pay off the debt, which would in turn require ongoing demand for the US Dollar.

- Recent news that Russia and China have suggested adopting the Chinese Yuan instead of USD to settle trade between themselves, African and South American nations.

- The Chinese-backed truce between Iran and Saudi Arabia and their proposed invitation to the B.R.I.C.S. (Brazil, China, India, Russia, South Africa) coalition of nations. This economic powerhouse, comprising over half the global population, is considering developing its own currency, directly backed by gold.

- France and China completing their first LNG gas trade using the Chinese Yuan.

- The recent meeting of ASEAN Ministers to discuss dropping the USD, EURO and Yen for local trade.

- Smaller nations losing trust in the US Dollar, e.g. Kenya’s President advising citizens to get rid of their U.S. Dollars, and El Salvador’s recognition of Bitcoin as legal tender.

What does this mean for Australian investors?

Australia, with its bountiful resource sector and resilient stock market is well positioned to weather these economic and geopolitical challenges.

But where should Australian investors look to insulate their portfolio from some of these risks?

Trust in the property market has been diminished, affected by rising interest rates. The share market is delivering unspectacular returns, with almost daily news of company layoffs and reduced profits. While these situations offer great opportunities for sophisticated bargain hunters, they may be too volatile for the retail investor, who may preference their time away from analysing company data and property reports.

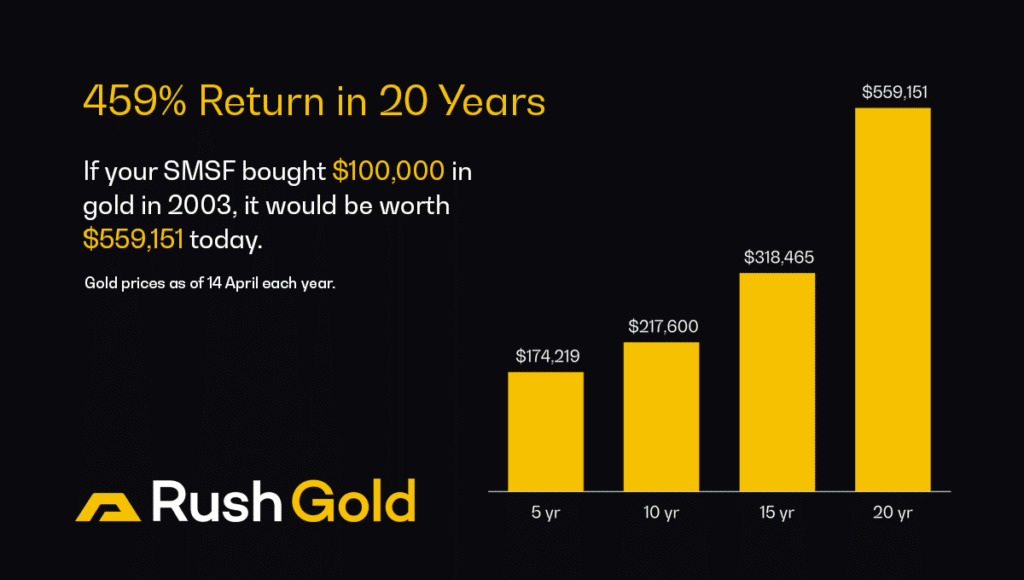

Enter the gold and precious metals markets. With their limited supply, political neutrality and highly liquid markets, gold and precious metals are proving their mettle as safe haven assets, which have seen increased demand recently from both central banks and retail investors.

This is not simply from the commonly noted phenomenon that ‘In bad times, gold does well’, as could be explained by the Ukraine war, global warming, the global pandemic or other non-fiscal event.

Rather, it seems evident that much of the current rise in gold prices is a direct result of a loss of trust in fiat currency itself and the established banking system.

After all, 1kg of gold is 1kg of gold, regardless of what currency it is traded against. Gold supply is incredibly predictable and increases require a lengthy runway of years, as new mining projects come on board.

Stability is a solid bar of gold. Innovation can be found in digitised ownership of that bar, which still retains direct title and is covered under Australian property law. New technologies allow it to be custodied, traded, spent and invested in the mobile and online domain, while outsourcing the difficult aspects of ownership, such as fractional trading, safekeeping and insurance.

Savvy sailors seek a safe harbour in a storm, and SMSF investors can too.

A physical metals financial services platform, Rush Gold is the simplest, safest way to own direct title to physical gold within your SMSF in any quantity. To find out more about opening a Rush Gold SMSF account, and access our exclusive e-book, click here.

Content provided by:

Disclaimer:

The information contained in this article is general information only. Any advice is general advice only. Neither your personal objectives, financial situation nor needs have been taken into consideration. Accordingly you should consider how appropriate the advice (if any) is to those objectives, financial situation and needs, before acting on the advice.