Content provided by OTG Capital

Written by Ray Trevisan, Director, OTG Capital Pty Limited

Why bonds?

I have previously written about bonds and I’m often asked why I focus on them. Why do I have a “thing” for this asset class rather than following the herd with shares and cash.

I blame this fixation on my age and personal sentiment. I am also a control freak but mostly, I like bonds because they help keep my blood pressure within a healthy range.

As a one time share day trader, I played and shorted US shares during the height of the GFC meltdown and can rightly boast a great annualised result – ~20% (before exchange rate and tax = ~3%!!). Side effects? Lack of sleep, no fingernails, a frayed nervous system, and a cranky wife.

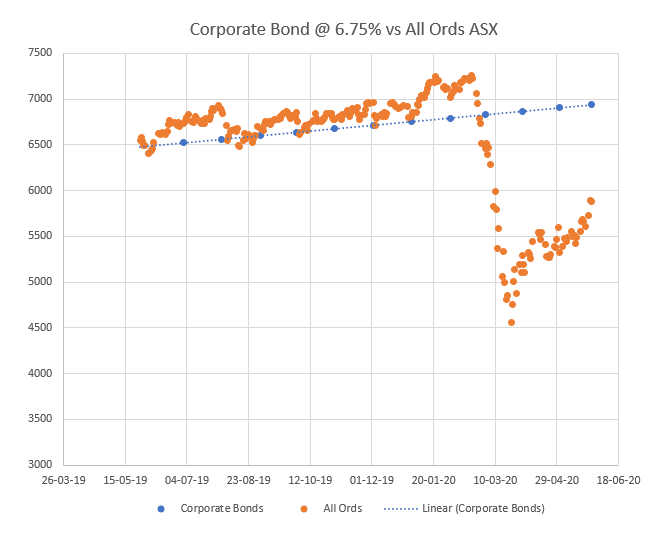

2020 has seen the All Ords start the year at 6810, move up 6.5% in 3 weeks, drop 2.5% in 12 days, rise 3.3% in 17 days, drop 37% in 1 month, and then rise again 29%[1].

So, how is your blood pressure doing so far this year?

The corporate bond coupon rates over this same period of time have eased somewhat in line with the easing of the RBA cash rate (now only 25 basis points). However in general, bond yields have remained consistent and stable since the beginning of 2020 as they were throughout most of 2019.

Shares Will Always Outperform Bonds

The reason I like bonds is they suit my risk tolerance and they suit who I am as an investor – pure & simple. I’m not a total conservative with everything tied up in cash deposits. I understand my money needs to work hard to beat inflation and tax.

I’m just not comfortable following the masses into “blue chip” stocks that deliver the occasional big bang (A2 Milk, CSL and AfterPay are recent examples). While not everybody jumped on these shares to make extraordinary profits, of those who did, how many investors fess up to their mistakes (AMP, Telstra)?

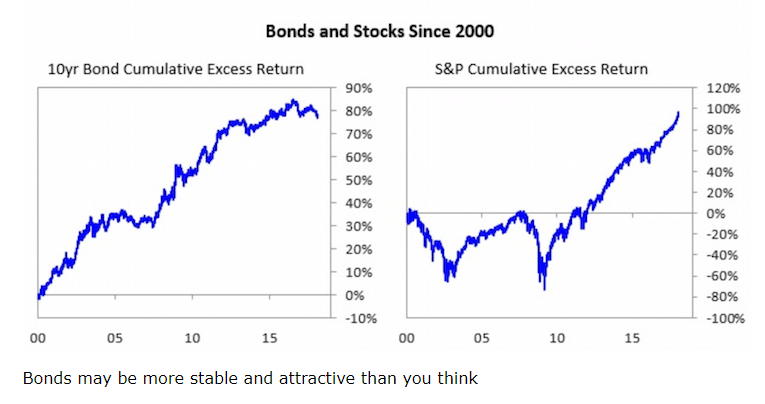

It is consistently true shares over a long period of time deliver better returns than bonds and cash, but this only works if you buy and hold a reasonable basket and withstand the temptation to exit or panic buy poor choices[2].

Source: Financial Samurai

Stock Picking Ain’t Easy!

Stock picking is exceptionally difficult.

Warren Buffet[3] has proved active hedge fund managers; the supposed experts, performed no better than someone with Indices ETFs. Personally, throwing my bets to the wind when it comes to my retirement at this stage of my life is not a viable plan.

There are five asset classes that investors can chose from yet, I am dismayed most people I meet at investor shows, discussions groups and industry days are focussed on shares, cash and little else[4]. I don’t tend to count real estate in this mix if the item is the family home. For most, making money on where you live tends to be a nature of good fortune rather than good management, if we are realistic.

Hence, my ongoing love affair with bonds (and I’m not referring to low yield, poorly performing government bonds). They provide me a relatively consistent way forward that is slightly higher on the risk profile than cash and term deposits, but nowhere near the risk profile of shares and, importantly for me (and possibly you too), they are relatively simple to understand, easy to invest in, and provide modest to strong returns without the drama and stress of the market volatility we are currently living through.

This pandemic still has a long way to run, and there is no vaccine on the foreseeable horizon. I contend forecasts of “snap backs” and “greenshoots” are premature. I’ve written previously on bonds, and a quick refresher will tell you they are simply loans. There are tips, tricks and traps to investing in bonds, but for mine, they are a steadier long-term investment.

Source: Yahoo Finance 12 month All Ords data vs OTG Capital Investment Trust yield

I will always concede over any reasonable period of time, shares will outperform bonds. My argument for bonds simply comes down to “the ride” along the way. When you look at these comparative yield graphs – one delivers better than the other a lot of the time, but I know which one is easier to manage and traverse, and which one is better for my blood pressure!

[1] as at 27 May 2020, ASX All Ords

[2] I also acknowledge many investors buy Australian blue chip stocks purely for the franking credits – which is in fact a form of government subsidised rebate – which acts similar to a bond.

[3] https://www.investopedia.com/articles/investing/030916/buffetts-bet-hedge-funds-year-eight-brka-brkb.asp

[4] I’ve seen various estimates that only 6 – 8% of Australian investors actively invest in bonds.

For more information, please visit the OTG Capital Pty Limited website.

Content provided by:

About the Author

Ray Trevisan is an Authorised Representative (AR:001250963) of Lifestyle Asset Management, who is the holder of an Australian Financial Services License (AFSL:288421). Ray holds a Master of Management from the University of Technology (Sydney), is a Graduate of the Australian Institute of Company Directors (AICD), NSW Justice of the Peace (JP), an accredited Financial Planner (Dip FinPlng) and member of the Financial Planning Association of Australia (FPA).

Ray has a regular radio show & podcast, Dollar$ and Making $ense. He also has over 40 years of business and investing experience and operates the northern beaches office of OTG Capital in Newport Beach, NSW.