Written by Paul Miron, Managing Director, Msquared Capital

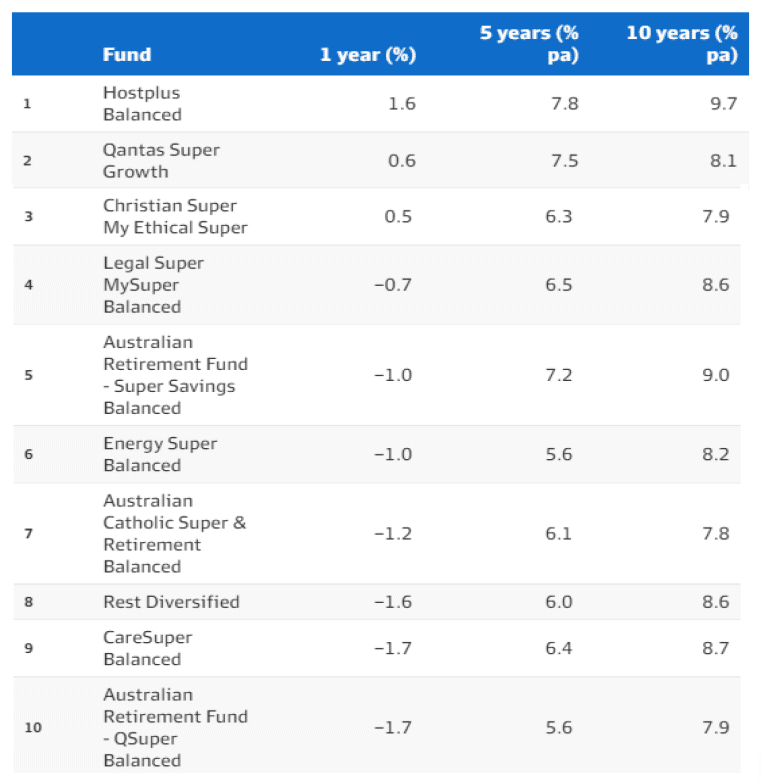

In our July board meeting with our Chairman, we discussed a recent article, titled “Super Shake Up”, featured in the Australian Financial Review. It ranked the performance of the 50 largest ‘balanced’ (or ‘growth’)1 Superannuation Funds in Australia, with only 3 reporting an absolute profit (of 1.6%, 0.6% and 0.5%) for the 12 months to June 30, with the remaining 47 recording losses for their investors.

I am sure Super Funds and Investors will be closely examining the results to identify the ideal composition of a portfolio to outperform competitors and the index.

Australia’s Superannuation Sector

Australia’s superannuation sector manages roughly $3.4 trillion, impacting the majority of Australians’ financial future.

One of the biggest controversies is not that this is a terrible outcome for investors. Rather, it is about the so-called ‘unfair advantage’ some firms are enjoying regarding the accounting treatment of unlisted assets.2 By investing into unlisted assets, valuations are not reflected as frequently as they are for listed assets, which undergo a near-constant process of price discovery.

Fund managers in this sector have faced a plethora of economic challenges, including rampant inflation, rapidly rising interest rates, declining asset values, geopolitical uncertainty, cost pressures, additional costs as we transition into green energy, a war in Europe, supply chain issues…and the list goes on. Most fund managers make clear that conditions will worsen before getting better due to these challenges not abating any time soon.

In essence, investors should not expect any pleasant surprises in the next 12 months, with many ASX companies downgrading their profit forecasts due to the challenging economic environment. Perhaps now it is a matter of selecting the fund managers who will be less likely to lose more of your money relative to their peers. This is a bleak and dismal outlook considering a superfund that outperforms its peers may still be losing your money on an absolute basis.

The consensus between super fund managers referred to within the article indicates a desire to transition away from traditional asset classes and allocation styles, and instead seek greater exposure to alternative asset classes with a more defensive position.

The time for fund managers and investors has never been more appealing for considering the benefits that Private Credit can offer to a diversified portfolio given its asset preservation qualities and consistency of income. The importance of this can hardly be understated in our highly uncertain economic environment.

Confusions in Risk-assessment

Now, here is the paradox: consider Msquared Capital – a fixed-income fund manager (Private Credit Provider) that manages direct mortgages. Investors would not react with the same silent acceptance if we produced the same financial outcomes as the superannuation funds in the past 12 months.

If we provide investors with the bad news of negative returns, it would be catastrophic for our business.

On the contrary, the average performance of all the direct mortgages we have written for the past five years is 8.00% p.a., with the benefit of consistent monthly income, no volatility and no losses. Over the past 5 years, we have done significantly better than all the super funds mentioned in the AFR article. Being nimble, we are able to tailor our debt investment opportunity in a way that will complement your risk appetite and overall portfolio.

Perhaps this can be better illustrated with the following insights from American economist, Steven Levitt, known as ‘the economist exploring economic riddles’:

“Why do people fear flying as opposed to driving?” Research shows that 30% of us are petrified of flying despite it being considered one of the safest modes of travel from a statistical perspective. You are 2000x more likely to die in a car accident than taking a flight.

Why would this be the case?

It comes down to our biology and psychology. As humans, we are TERRIBLE assessors of risk.

When we enter a car, we are more accepting of risk than when we enter a plane due to perceived control. Additionally, a plane crash is more likely to be instant and fatal, which is the logic behind people’s fear of flying compared to getting into a car.

The same paradox exists when you entrust your money with a fund manager who invests in shares and bonds. In the event of an absolute negative return, they do not have control over changes in the market, which no one can control. Yet, we accept the volatility and shaky performance, while remaining committed to the investment in the long-term. We ride the wave of random yearly returns and accept the risks, even as poor performance is clear, as was the case in the 12 months to June 30.

Investing solely in bonds and shares is the equivalent to driving in the car; investing in alternative asset classes, such as mortgages, is like flying in a plane – less objectively risky, yet many have an irrational fear towards it. This highlights the importance of assessing risk objectively.

Private Credit – Lower Risk, Higher Return

Now, let us look at Msquared Capital – a private lender who secures loans via first registered mortgages. Perhaps, similar to a plane crash, people fear the immediate and uncomfortable fear of an absolute loss of capital when the borrower cannot repay their debt and return money to you, the investor. However, not all types of debt are the same, and neither are the managers.

Firstly, when investing in a secured mortgage investment, risks can be controlled and measured. For example, at Msquared Capital we choose whom we lend to, how long for, the rates we charge to borrowers, and of course, the return we provide to investors based on their risk-reward preference. Most importantly, we ensure that we are secured by high-quality real estate so that we are protected in the event the borrower defaults. We position ourselves in a way that we can recover both the principal and interest. This is how we have been delivering and will continue to deliver consistent and reliable returns for our investors.

Most Australians fear investing in mortgages where risks are well-defined compared to the risks inherent in shares and bonds. This is despite the statistical performance being exceptional for mortgages, with stable and predictable returns as long as the fund manager is both disciplined and adheres to tried and tested principles.

Perhaps Australia is still in the embryonic stages of the private credit market, with firms like Msquared Capital making up only 8% of the commercial loan market. This is a number dwarfed by the US and Europe, where 70% and 50%, respectively,5 of commercial loans are written by private credit providers. In the US and Europe, this sector is not defined as an ‘alternative asset class’ or an ‘exotic investment’, but is proudly named as ‘Private Credit’ and is a mainstream investment option.

Banks, Bonds and Msquared Capital

The concept of debt first appeared 3500 years ago in the Sumer Civilization.6 Private Credit providers today, such as Msquared Capital, are not too dissimilar to a bank’s primary operations in collecting deposits (in our case, investor funds) and lending money to borrowers. The significant difference is the ability of banks to borrow money from the Reserve Bank as cheaply as to generate debt from deposits, roughly a 1:5 ratio.7 Arguably, this cheap “free money” points out sometimes as being unfairly subsidised by taxpayers. Despite the fundamentals of our business model being very similar to banks, we are referred to as an ‘alternative asset class’ in Australia.

To read Msquared Capital’s full article on the paradox of investing, click below to download the full article.

Content provided by:

Disclaimer:

Msquared Capital Pty Ltd ACN 622 507 297, AFSL No. 520293 (Msquared) is the Trustee of Msquared Contributory Mortgage Income Fund.

The information contained on this website should be used as general information only. It does not take into account the particular circumstances, investment objectives and needs for investment of any investor, or purport to be comprehensive or constitute investment advice and should not be relied upon as such. You should consult a financial adviser to help you form your own opinion of the information, and on whether the information is suitable for your individual needs and aims as an investor. You should consult appropriate professional advisers on any legal, stamp duty, taxation and accounting implications of making an investment.

The information is believed to be accurate at the time of compilation and is provided by Msquared in good faith. Neither Msquared nor any other company in the Msquared Group, nor the directors and officers of Msquared make any representation or warranty as to the quality, accuracy, reliability, timeliness or completeness of material on this website. Except in so far as liability under any statute cannot be excluded, Msquared, its directors, employees and consultants do not accept any liability (whether arising in contract, tort, negligence or otherwise) for any error or omission in the material or for any loss or damage (whether direct, indirect, consequential or otherwise) suffered by the recipient of the information or any other person. The information on this website is subject to change, and the issuer is not responsible for providing updated information to any person. The information on this website is not intended to be and does not constitute a disclosure document as those terms are defined in the Corporations Act 2001 (Cth). It does not constitute an offer for the issue sale or purchase of any securities or any recommendation in relation to investing in any asset.

Investors should consider the Fund’s Constitution, Information Memorandum (IM) and relevant Loan Memorandum (disclosure documents) containing details of investment opportunities before making any decision to acquire, continue to hold or dispose of units in the Fund. You should particularly consider the Risks section of the Information Memorandum and relevant Loan Memorandum. Anyone wishing to invest in a Msquared Contributory Mortgage Income Fund will need to complete an Application Form. A copy of the IM and related Application Form may be obtained from our office via email request from [email protected].

Past performance is not indicative of future performance. No company in the Msquared Group guarantees the performance of any Msquared fund or the return of an investor’s capital or any specific rate of return. Investments in the Fund’s products are not bank deposits and are not government guaranteed. Total returns shown for Msquared Contributory Mortgage Income Fund have been calculated net of fees and any distribution forecasts are subject to risks outlined in the disclosure documents and distributions may vary in the future. All figures and amounts displayed in this email are in Australian dollars. All asset values are historical figures based on our most recent valuations.

The information found on this website may not be copied, reproduced, distributed or disseminated to any other person without the express prior approval of Msquared.