November 2021

Content provided by The Perth Mint

Content provided by The Perth Mint

Interest towards including gold as part of your superannuation investment is growing, but there are some key questions to ask to understand which options might be right for you.

Compulsory superannuation turns 30 this year, a milestone that means most working Australians should be building a solid nest egg for their retirement.

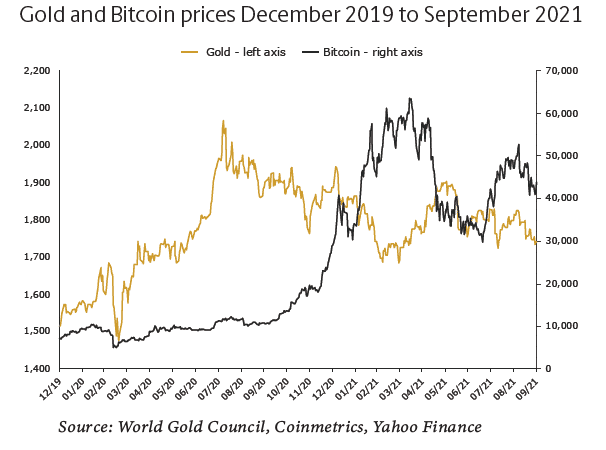

But those past 30 years haven’t been all clear sailing. The All Ordinaries has been negative in eight calendar years in the past three decades1, while the younger S&P ASX200 has had four negative years2 in the past 10. In contrast, the AUD price of gold has had two negative calendar years in the past decade, helping to explain why there’s renewed focus on bullion as part of a superannuation portfolio.

Why gold?

For millennia, gold has been highly sought-after – initially because of its inherent value as a currency, in jewellery and as a safe investment during times of strife. Increasingly it is also viewed as a safe option for superannuation funds and managed funds at times when other asset classes have faltered. The past two years have seen surging interest in gold among exchange-traded fund investors3, even before the pandemic caused markets to become jittery.

As a hedge against market uncertainty and risk it is a long-term performer, and in a period of low real interest rates and negative yielding debt, gold’s safe haven reputation has been reinforced. Investors who wish to explore gold as an option for superannuation can consider posing these questions to a financial adviser before making a commitment.

Is gold the right option for my investment?

An investment in physical gold does not pay a dividend like a blue-chip ASX stock so potential investors should be aware that growth comes from an appreciation in the price of spot gold — and therefore the value of their gold investment.

But historically it has been an excellent hedge against inflation because the gold price tends to rise when the cost-of-living increases4.

Investors also flock to gold when faced with uncertainty and confusion – the turbulence in US politics, global trade wars and the COVID-19 pandemic are just three reasons why today’s gold price remains strong.

No two super funds are the same but shares and property are largely the financial vehicles of choice for most growth-focused retirement investments, be they self-managed or through an institution, because they offer diversity, liquidity (in the case of shares) and annual income in the way of dividends or rental payments.

Depending on risk appetite, funds will also have varying levels of investment in cash, fixed income, infrastructure, unlisted equities and ‘other’.

Physical gold – that is, actual gold compared with investments in gold mining companies – falls into the ‘other’ category, which makes it an attractive option for further safely diversifying a self-managed superannuation fund.

Content provided by:

Disclaimer: Any opinions expressed in this article are subject to change without notice. The information in this article and the links provided are for general information only and do not contain all information that may be material to you making an investment decision. The Perth Mint is not a financial adviser and nothing in this article constitutes financial, investment, legal, tax or other advice. Before making an investment decision you should consider whether it is suitable for you in light of your investment profile, objectives, financial circumstances and the merits and risks involved. You should consider seeking independent financial advice to check how the information in this article relates to your unique circumstances. All data, including prices, quotes, valuations and statistics included have been obtained from sources The Perth Mint deems to be reliable, but have not been independently verified by The Perth Mint and we do not guarantee their accuracy or completeness. The Perth Mint does not accept any liability, including without limitation any liability due to any fault, negligence, default or lack of care on the part of The Perth Mint, for any loss arising from the use of, reliance on, or otherwise in connection with the information contained in this article.