Welcome to our second instalment for the new financial year. We continue to see markets, while volatile, trend up with equity markets in the USA reaching new highs. While in Australia we are seeing results season provide insight to how companies have fared through the pandemic.

Some commentators are suggesting that markets may be running ahead of the true underlying fundamentals of the economy. Others are saying that growth will continue from certain sectors such as technology. While those in the middle say there are two markets; one which has performed well through COVID-19 and the other that may not recover or play a significant role in the future.

I’m sure these commentaries, or me repeating them here, may not be helping investors and SMSF trustees take a long-term view of their investment portfolios. So once again, let’s return to some of the basics starting with diversification, asset allocation and portfolio construction.

Against this backdrop let’s consider where property as an asset class and possibly its close relative infrastructure may fit into portfolios.

Sorry, this content is reserved for members of our SMSF Connect community.

Please register for a free community account to view this content or login below.

Login

If you are an existing member of SMSF Connect, please login below.

If you wish to learn more about joining the community, please click here.

Join the free community

Complete the form below to set up your free account and be regularly updated on SMSF and investing news and information.

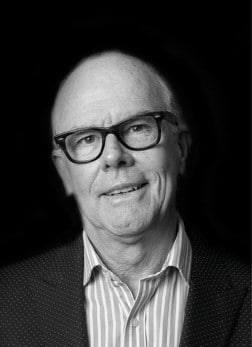

Ian Irvine - Guest Contributor

Ian has been a keen investor for over 40 years and can draw on his experiences from both investing on his own behalf and also having worked in financial services for more than 30 years. Over this time, he has seen many changes that impact investors’ attitudes to in what and how they invest.

He started his career in what is now referred to as fast moving consumer goods (FMCG) or grocery, working for an Australian margarine manufacturer. In 1986, he was recruited to Westpac around the time of deregulation of the sector, where he spent 10 years before taking a role at AMP and then with ASX for 14 years up to the end of 2017. He continues to be involved with ASX; working on their educational programs.

In 1996, he and his wife established their own SMSF and again the experience and lessons learned regarding managing an SMSF over the years have provided him with many insights and ideas. He enjoys sharing these with others where these are helpful and always suggest that if an investor or SMSF trustee is unsure, that they should seek appropriate advice from a licenced professional.

Ian holds a B. Com (UNSW), and lives in Sydney and enjoys travelling to and meeting investors and SMSF trustee at the educational events with which he has involvement with from time to time.