Superannuation Rollover From Your SMSF

A superannuation rollover is when a member transfers some or all of their existing super between funds. This means a member can transfer superannuation benefits from their SMSF to another complying fund, even though they may not satisfy a ‘condition of release’. To help you navigate this along with super contributions, we have created this step-by-step superannuation rollover course.

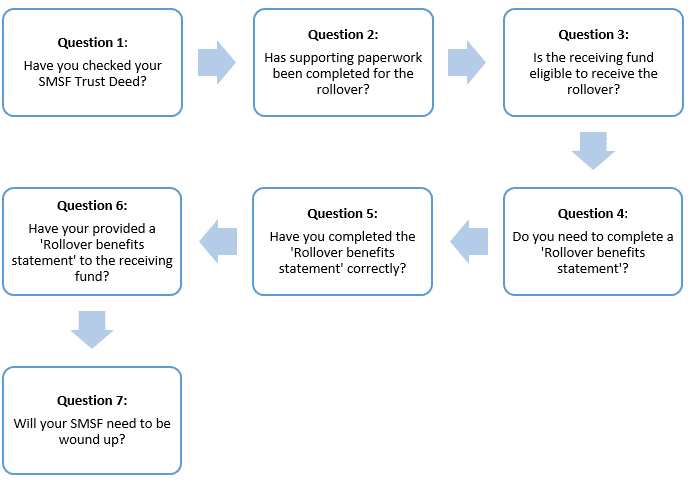

As shown in the diagram below, this course will ask you questions about SMSF Trust Deeds, whether you have provided a Rollover Benefits statement, if you need to do a SMSF wind up and more. It will also help you to ensure you’re complying with the Australian Taxation Office’s superannuation rollover rules and laws.

DISCLAIMER: The information on this website does not seek to provide personal advice specific to your needs or super account. It is intended only as a guide for illustrative purposes only. We encourage you to seek advice from an SMSF Specialist.

Superannuation rollover: tax consequences & preservation rules

No tax is generally payable on superannuation rollovers or transferred from one superannuation fund to another. The preservation components of a member’s rolled over benefit are maintained in the new fund, which means that the rolled over benefit can only be accessed once the member has met a condition of release.

Have additional questions about rolling over superfunds or how to self manage my super? We also have courses on how to rollover super to SMSF, the basics of setting up a SMSF and more. Please register for a free community account to view them.

Lessons associated with this course are reserved for members of our free community and SMSF Connect members.

Please register for a free community account to view the full course. If you are already an existing member, please login.

If you wish to become a member of SMSF Connect, please click here.